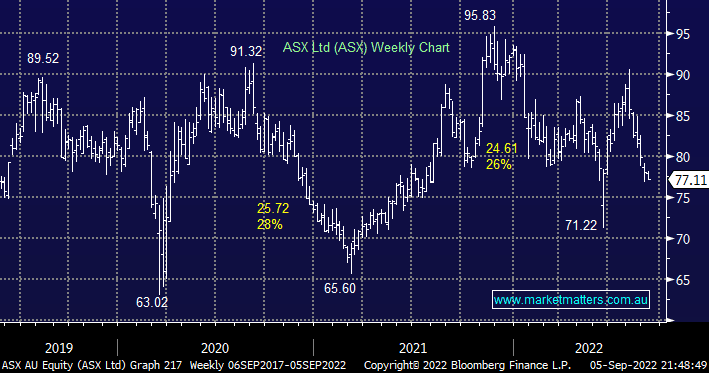

The Australian Stock Exchange, or ASX, is one defensive stock that hasn’t lived up to its reputation over the last 12 months having endured a -26% pullback from its 2021 high. The operating position is not a pretty picture at the ASX with cost issues growing due to wage inflation compounded by a required increased headcount to deliver on tech investments, the Capex outlook is also increasing due to the delay in CHESS replacement which will translate to higher costs in the coming years – we expect cost growth to outpace revenue for at least 3-4 years.

- We like the risk/reward for the ASX if it dips well under $70 i.e. more than 10% lower.

- This week’s $1.20 fully franked dividend may appeal to some yield-hungry investors but it’s not on our menu.