ASX -10.22%: the share market operator hosted an investor day today with the company facing continued delays to the replacement of the aging CHESS system which handles trade settlements. The 29-year-old system will cost an additional is the main driver of a ~12% increase in costs in FY23 and 12-15% growth in FY24 with the company also planning on spending $110-140m in capex next year on technology and regulatory concerns, likely above the previous peak of ~$110m in FY21. Further squeezing the ASX is falling market volumes and listing numbers largely on the back of cautious investors and one of the worst IPO runs in history. The soft update, which included lowering payout guidance, drove shares to a 4 year low today.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

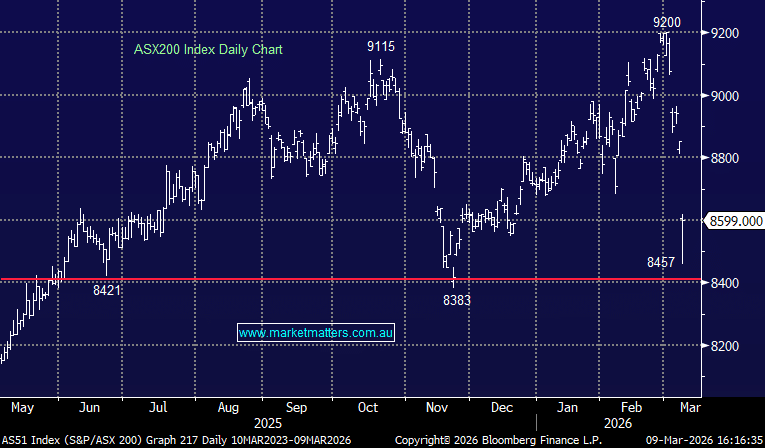

MM is neutral to bullish ASX

Add To Hit List

Related Q&A

ASX Limited (ASX) and Nuix (NXL)

Takeovers and a shrinking ASX.

Thoughts on ASX (The stock) for income

MM’s view on ASX?

MM views on ASX

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.