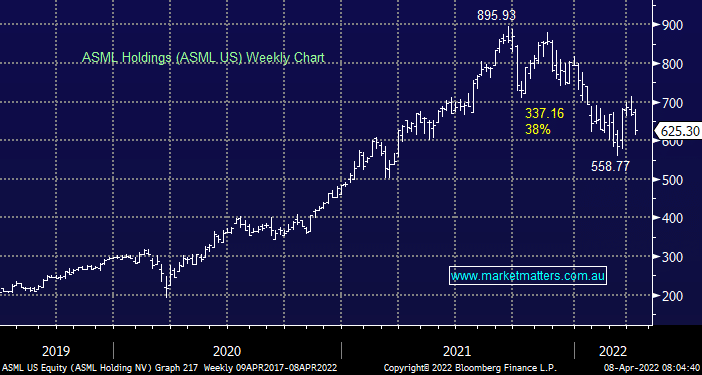

ASML is a provider of advanced technology systems for the semiconductor industry, even after correcting 38% the stocks not cheap but into fresh 2022 lows around $US550 the risk / reward and valuation will look very attractive to MM. The company is the world’s largest manufacturer of lithography systems and has companies like Samsung and Taiwan Semiconductor Manufacturing depending on its products enabling it to deliver stable revenue growth while margins are expanding.

The Dutch semiconductor equipment maker also faces some near term challenges but the price drop we believe has already largely factored these scenarios into the price:

- Ukraine is the world’s largest producer of neon gas which ASML uses, America & Holland keep barring it from shipping its top-tier EUV systems to Chinese chipmakers, and overall it’s being sold off due to its European location.

We like this business into its current weakness as it remains the crucial linchpin of the world’s chipmaking market.