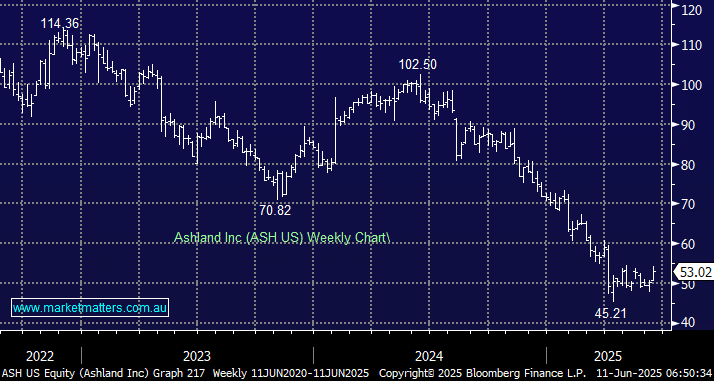

We’ve retained Ashland Inc on the Hitlist for the International Equities Portfolio, awaiting a catalyst to buy. Our last updated opinion was in December, yet the share price has remained under pressure since. Earnings expectations have been revised lower which has been a trend since earnings peaked in 2022. Lower expected earnings = lower share price. Inflexion points in earnings generally lead to inflexion points in share prices, amplified by a re-rate in the earnings multiple applied to those earnings. Down in the case of a stock running hot, where earnings peak, and up in the case of a stock running cold, where earnings bottom. We believe Ashland is showing early signs that earnings may now be at an inflexion point.

As a recap, Ashland manufactures and sells additives that go into pharmaceuticals, personal care products, paints, food & drinks to make them do what they need to, whether that’s to be shiny, durable or release in a certain way. While additives are a very small part of a production process and their cost is generally a tiny part of the cost, they are central in the production of many things. That said, manufacturing weakness in the US, impacted by tariffs, has had a negative impact on Ashland. We think the worst of tariff-related impacts are near complete, and as a greater level of certainty emerges, Ashland should be a net beneficiary.

Additionally, Ashland falls into the deep value, unloved pocket of the market, which is starting to gain more traction as equity indices trade near all-time highs again.

- We view ASH as an undervalued turnaround opportunity where earnings could trough in 2025, before recovering from 2026 onwards. While we are not pressing the buy button just yet, we are keeping ASH on close watch.