As major indices continue to track around all-time highs, we’re becoming more conscious of looking beyond the well-known names in the US market that have been primary drivers of the strength, into more industrially focused companies that will benefit from a broadening of the market rally.

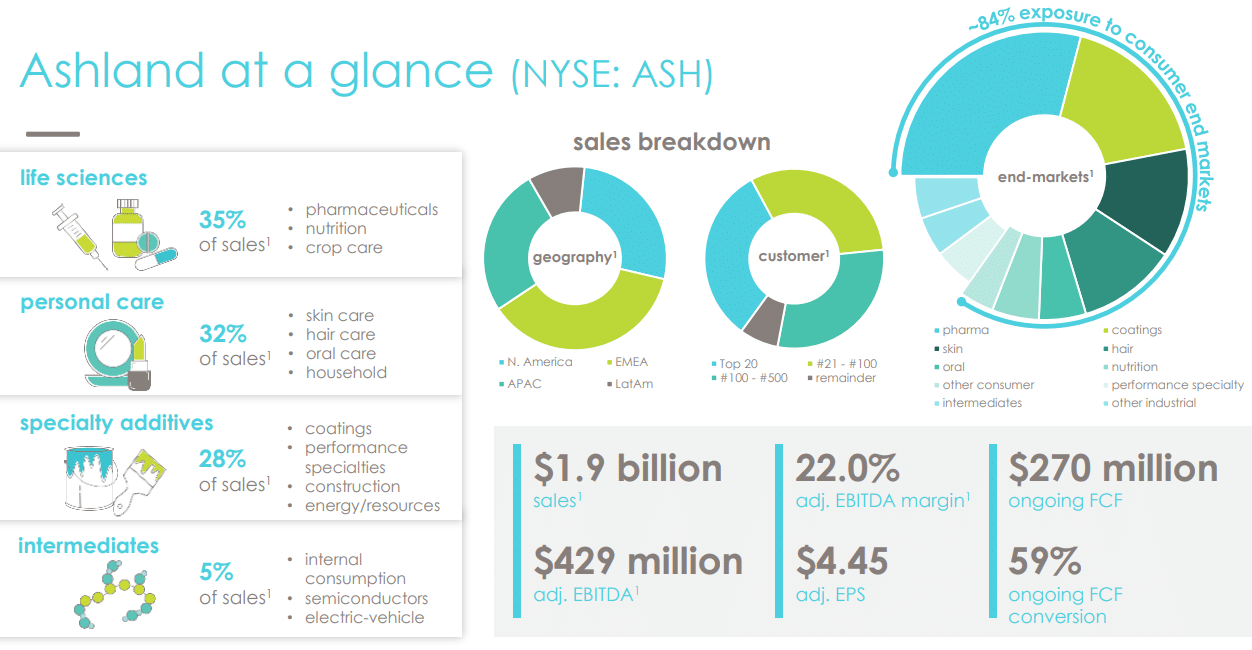

US-listed additives company Ashland this week celebrated its 100th anniversary of operation, no mean feat, having transformed itself from an oil and refining company to a chemical company and now to the focused additives and speciality ingredients company it is today. They also held a strategy day yesterday, which, following a tough few years due to supply chain issues and inflationary pressures, provided a mildly more positive outlook into 2025.

Additives go into too many things, but the reality is that things like pharmaceuticals, personal care products, paints, foods & drinks have additives to make them do what they need to, whether that’s to be shiny, durable or release in a certain way. While additives are a very small part of a production process and their cost is generally a tiny part of the cost, they are central in the production of many things. For example, a drug that has a specific additive approved by regulators, that additive cannot be easily changed, or when an additive is engrained in a particular manufacturing process, the costs to amend most of the time, outweigh the benefits, making this a very ‘sticky’ product, which is the point Ricky made in his pitch.

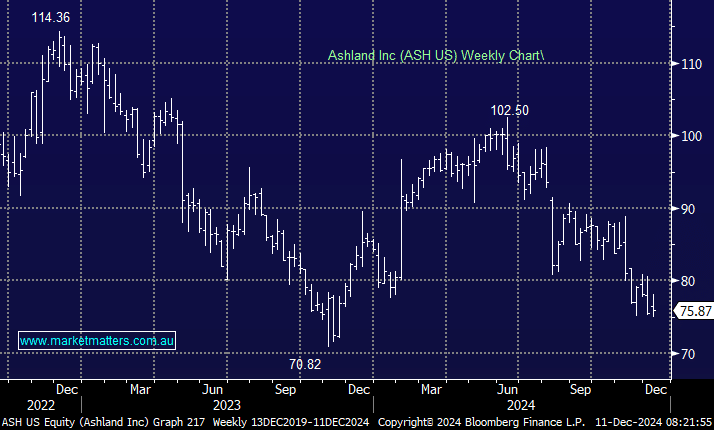

- We’ve had Ashland on the Hitlist for the International Equities Portfolio for some time, and it’s remained under pressure, void of a catalyst to see the share price move. We view ASH as a defensive, moderately priced stock that remains a likely candidate for the portfolio.