Ricky Sandler, the CIO at New York-based hedge fund Eminence Capital, presented first at this week’s Sohn Hearts and Minds conference. The order in which the 11 fund managers present is decided by how well their stock picks have done from last year’s event, a great idea for accountability! So, while Ricky was first up having last year’s best bet, Jun Bei Lu from Tribecca was the last cab off the rank!

While MM didn’t attend the event, we thought about the ideas presented, discussed them in the office, and dug deeper into things we found interesting. One of those this year is Ashland, a US-listed additives company that has had a difficult year due to lingering supply chains and inflationary pressures, but the outlook for the coming years looks better. Additives go into too many things, but the reality is that things pharmaceuticals, personal care products, paints, foods & drinks have additives to make them do what they need to, whether that’s to be shiny, durable or release in a certain way. While additives are a very small part of a production process and their cost is generally a tiny part of the cost, they are central in the production of many things. For example, a drug that has a specific additive approved by regulators, that additive cannot be easily changed, or when an additive is engrained in a particular manufacturing process, the costs to amend most of the time, outweigh the benefits, making this a very ‘sticky’ product, which is the point Ricky made in his pitch.

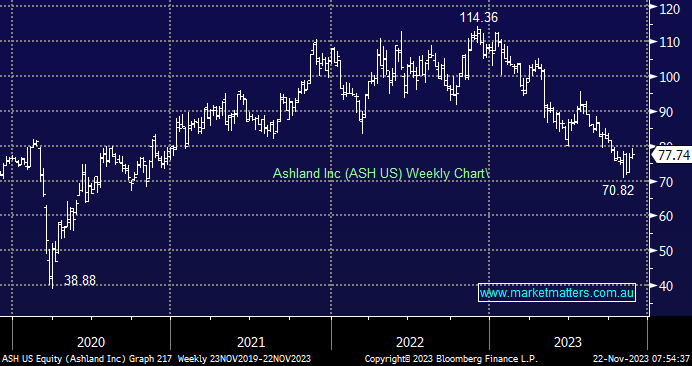

The chart over the past 12 months is not pretty, as higher input costs have pressured margins and, therefore, earnings, leading to downgrades, however, based on consensus numbers, FY24 is expected to be the low point in their earnings cycle with earnings tipped to almost double over the next two years. If the earnings meet consensus expectations, the stock is trading on an Est PE of 14x FY25, dropping to 10x FY26.

- This company produces a critical but small component for many products and seems to be at an inflexion point in terms of earnings, benefitting from lower inflation and lower interest rates.