ALL +2.6%: Was down early before recovering to finish the day higher following the release of their FY24 results that were largely inline with expectations, underpinned by good US earnings which offset a softer performance in other regions.

- Normalized operating revenue $6.60 billion, +4.9% y/y, estimate $6.72 billion

- Normalized Npata $1.56 billion, +17% y/y, estimate $1.55 billion

- Final dividend per share $0.42 vs. $0.34 y/y

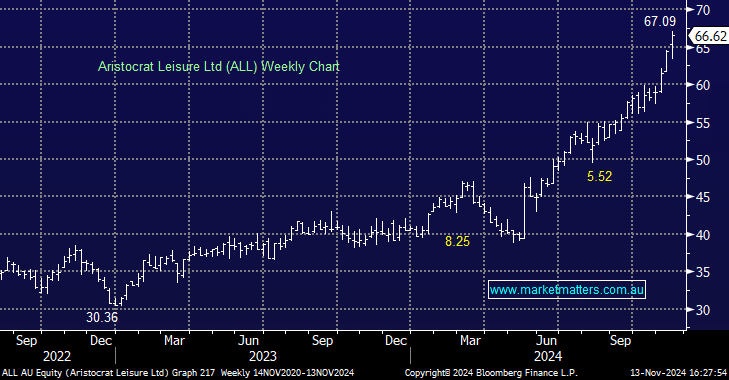

They have guided for growth in adjusted earnings in FY25 without being specific, up against consensus which is looking for a +6% increase. It’s hard to get excited about ALL into new highs, trading on an Est PE of 25x, around 1 standard deviation on the expensive side