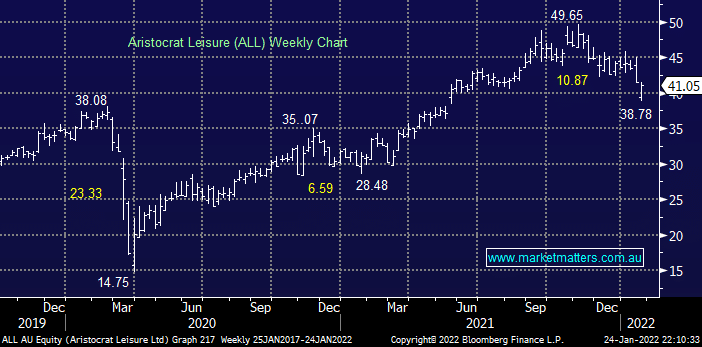

Gaming machine company ALL has corrected well over 20% since November taking its lead from the tech based NASDAQ plus there have been concerns it would enter a bidding war for US listed Playtech however its $5 billion bid is looking good now that rival bidder JKO Play has withdrawn plus ALL’s position has probably strengthened in today’s nervous market as the chances of investors accepting the bid may have risen. Either way we like the company into current weakness as it will be a definite beneficiary as the global economy reopens post Omicron.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Buy Hold Sell: The best and worst performers of FY25

Buy Hold Sell: The best and worst performers of FY25

Close

Close

Friday 15th August – Dow off -11pts, SPI up +8pts

Friday 15th August – Dow off -11pts, SPI up +8pts

Close

Close

Thursday 14th August – ASX +66pts, WBC, TLS, PME

Thursday 14th August – ASX +66pts, WBC, TLS, PME

Close

Close

MM likes ALL, ideally under $40

Add To Hit List

Related Q&A

Updated thoughts on Aristocrat Leisure (ALL)

ADA

LNW

Thoughts on Aristocrat (ALL) and National Storage (NSR)

How should we handle the recent rally in SEK, AD8, HUB, REA & ALL?

Does MM believe Aristocrat (ALL) a buy here?

Thoughts on Aristocrat (ALL) and PointsBet (PBH)

Short term price targets for various stocks

Is it time to book profits in CBA & ALL?

Technical setup for ALL

ALL, CTD, CGC, A2M

Relevant suggested news and content from the site

Video

WATCH

Buy Hold Sell: The best and worst performers of FY25

James Gerrish & Henry Jennings

Podcast

LISTEN

Friday 15th August – Dow off -11pts, SPI up +8pts

Daily Podcast Direct from the Desk

Podcast

LISTEN

Thursday 14th August – ASX +66pts, WBC, TLS, PME

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.