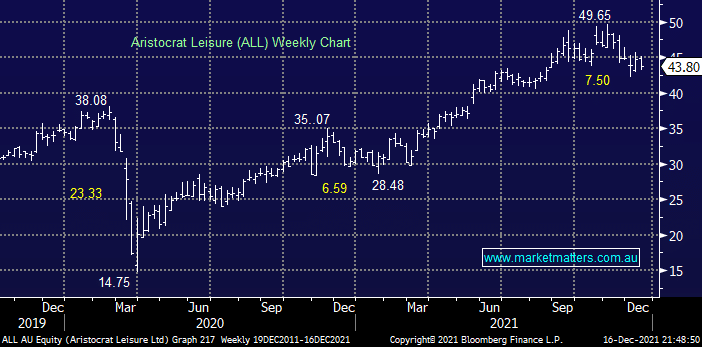

ALL has performed admirably post COVID and unfortunately this has proved to be one position where MM took profit too early but we’re always prepared to repurchase a stock at a higher level if we feel the reasoning is correct i.e. it’s all about portfolio performance with a manageable degree of risk, not ego! The gaming technology company released a strong full-year result last month showing a 14.4% lift in revenue to $4.7bn which we feel can grow especially as economies reopen.

If we see an ongoing dip into the $40-42 region on Omicron concerns, especially in North America where case numbers are soaring, we believe the stock will provide excellent value moving into 2022 assuming your ethics don’t prevent you purchasing a “pokies machine manufacturer”. We also like their proposed $5bn acquisition of gambling software group Playtech Plc (PTEC LN) although a rival bidder has now entered the affray.