Healthcare stocks caught our attention on Wednesday after their +1.3% advance. However, they’ve been a clear laggard in 2024, advancing only +2.1%, while four other sectors have delivered double-digit gains. The potential influence of the new wonder weight loss drug, Ozempic et al., has weighed on a couple of influential ASX names, but with interest rate cuts on the horizon, we question if this underperformance will continue. Another bonus from the sector is its label as a defensive play, a comforting addition to most portfolios with global equities pushing to fresh all-time highs.

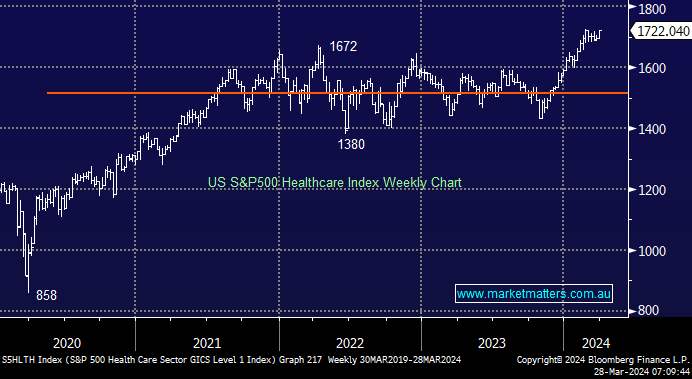

- Firstly, we’ve taken a quick look at the S&P500, as opposed to ASX, chart because the local healthcare index is dominated by $138bn behemoth CSL Ltd (CSL).

- The US Healthcare Sector tested all-time highs overnight, and further gains are likely over the coming weeks/months.

The local healthcare sector has a clear inverse correlation with bond yields falling noticeably as they rallied, i.e. “Bond yield tantrums in 2021 & 2023”. However, MM is of the opinion that we are close to seeing another dip in yields, which should provide a tailwind for the sector.

- We can see the local Healthcare Sector testing its 2020/21 highs through 2024/5.

This morning, we’ve very briefly updated our thoughts on 6 healthcare stocks as we consider portfolio tweaks as we exit 1Q of 2024.