Incredibly, China has banned firms that teach core school subjects from making profits, raising capital or going public posing the question, what’s left! This comes less than year since the Chinese regulators forced the pulling of the Ant Group IPO costing tech giant Alibaba $US60bn in the process, two things I’ve learnt that markets simply hate are uncertainty and excessive regulation which doesn’t bode well for a number of major names who will be almost scarred of what comes out of China next.

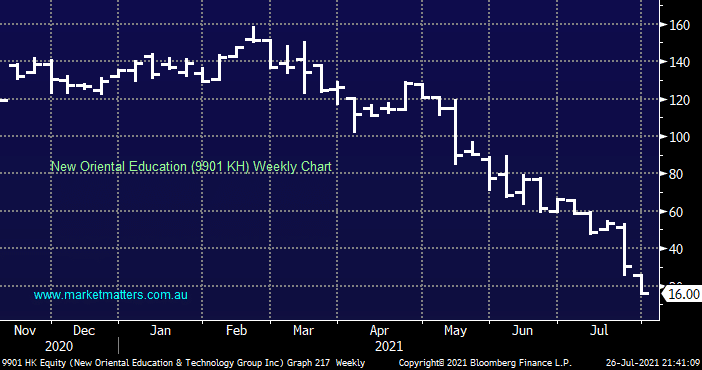

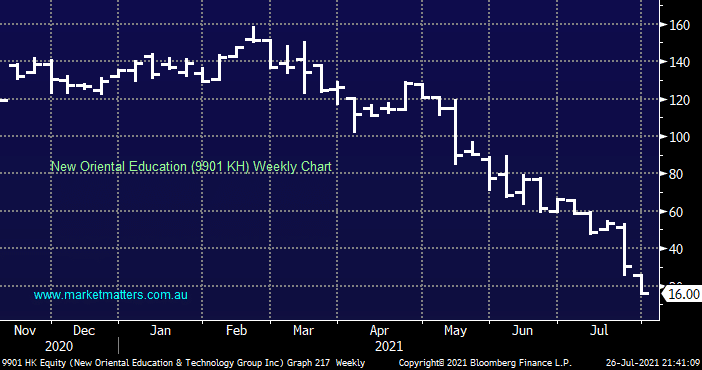

This dramatic move towards education was way more than a muscle flex by Beijing and the market listened big time with Larry Chen’s on-line education company (9901 HK) halving on the day, taking their descent to 98% from their February high, costing their founder his billionaire status in the process. Chinas move is actually a fairly logical one, they’re attempting to curb the spiralling educational costs that are discouraging families from having more kids, as we’ve seen locally with Treasury Wines (TWE) you simply don’t want to stand in the way of Chinese policy.

These new policies at the very least are likely to have a significant impact on the after school tutoring industry hence severely damaging the financial outlook of the participants in the process. My initial thoughts are pretty obvious, it puts the China education sector firmly in the too hard basket although it shouldn’t have a meaningful impact on similar companies operating in the likes of US, Europe and Australia. When I consider how important education is to the Chinese culture the only way I can see XI Jinping et al getting their way is to nationalise the industry and make it basically free, a move that would certainly make them popular on home soil!