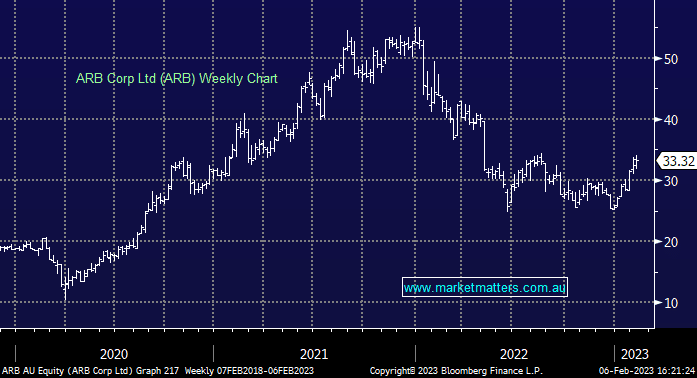

ARB -0.24%: Provided a positive trading update today ahead of their 1H23 results due out on Feb 21. While Sales revenue of $340.9m was down 5% on pcp, it is ahead of the $330.5m expected while the second part of the period (2Q) showed growth – so the worm is turning here. They also talked to inflationary pressures easing calling out freight & steel prices that are returning to more historical levels, clearly a positive for ARB but also interesting from a wider perspective. So, revenue is now growing and cost pressures are subsiding which will lead to improved margins. This was a good update from ARB after a tough period.

scroll

Question asked

Question asked

Question asked

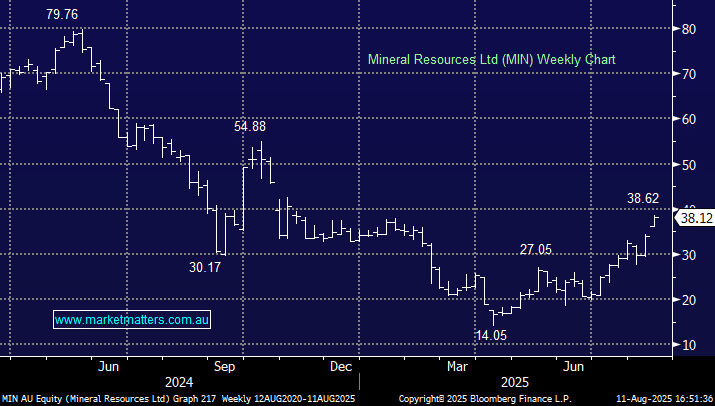

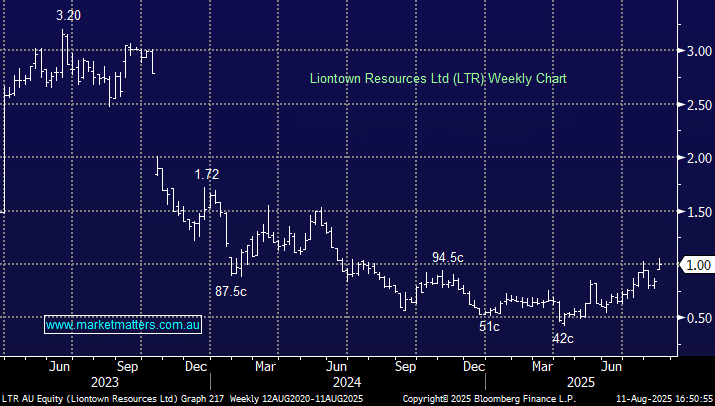

Buy Hold Sell: The best and worst performers of FY25

Buy Hold Sell: The best and worst performers of FY25

Close

Close

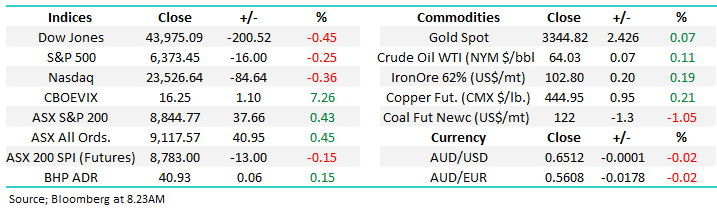

Tuesday 12th August – Dow off -200pts, SPI down -13pts

Tuesday 12th August – Dow off -200pts, SPI down -13pts

Close

Close

Monday 11th August – ASX +32pts, JBH, CAR, IRE

Monday 11th August – ASX +32pts, JBH, CAR, IRE

Close

Close

MM is now bullish ARB following a positive trading update

Add To Hit List

In these Portfolios

Related Q&A

ARB Corp Ltd (ARB)

NWL, ARB, HUB

What’s the best ‘car stock’ to buy?

Relevant suggested news and content from the site

Video

WATCH

Buy Hold Sell: The best and worst performers of FY25

James Gerrish & Henry Jennings

Podcast

LISTEN

Tuesday 12th August – Dow off -200pts, SPI down -13pts

Daily Podcast Direct from the Desk

Podcast

LISTEN

Monday 11th August – ASX +32pts, JBH, CAR, IRE

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.