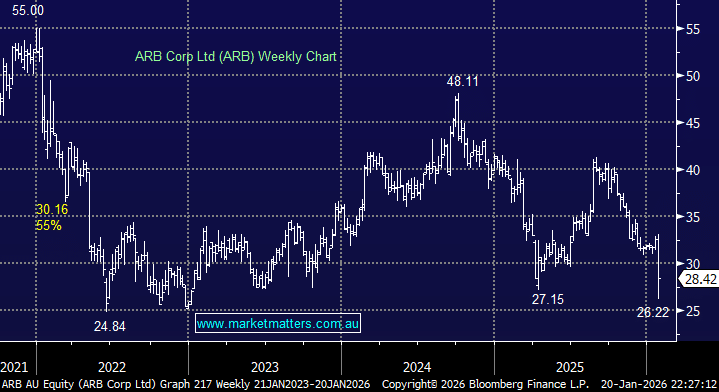

A tough one for ARB Corporation yesterday, flagging a material decline in earnings for 1H26 as confession season warms up (the period ahead of reporting when companies flag they’re unlikely to meet earnings expectations). In ARB’s case, tough domestic conditions couldn’t be fully offset by strength in its smaller export business.

- Sales revenue: $358m vs consensus $377.7m – down 1% YoY and a 5.2% miss.

- Underlying profit before tax: $58.0m (ex-one-offs), down ~16.3% YoY and an ~8% miss.

The OEM channel in Australia, where ARB sells items such as bull bars and 4WD accessories directly to vehicle manufacturers, was the key area of weakness, with sales through that channel down 38.2% for the period. This appears to be more related to dealer and fitting capacity constraints than any genuine weakness in end demand, but we’ll get a clearer picture when management provides further detail at the formal result and investor call on 24 February.

Encouragingly, the underlying trends in Australia’s new vehicle market remain strong, with sales near record levels. Around 1.24 million new vehicles were sold in 2025, slightly above 2024. Of particular importance for ARB, SUVs accounted for ~60% of total sales and light commercial vehicles (Utes) ~22%. The Ford Ranger was Australia’s best-selling 4WD and overall vehicle in 2025 (~53,700 units), followed by the Toyota HiLux (~45,800), highlighting sustained demand for dual-cab Utes and 4WD wagons. Despite month-to-month volatility and broader economic pressures, the structural preference for SUVs and Ute-type vehicles remains intact – an important pillar of our investment thesis for owning ARB in the Emerging Companies Portfolio.

Margins were also under pressure, driven by a weaker AUD versus the Thai baht. Thailand is a key offshore manufacturing base for ARB, particularly for steel-based accessories and export products, which offers cost advantages but also introduces currency risk. Lower-than-expected factory overhead recoveries compounded the margin headwind.

- One clear bright spot was exports, up 8.8% overall, led by the US market (+26.1%). This reinforces the view that Australian companies with meaningful offshore exposure are likely to fare better than those purely domestically focused.

Overall, it looks to MM that the sales weakness is more about capacity constraints than a weakening of the brand or end-market. The key question for earnings is how quickly ARB can add labour and throughput, as easing constraints can drive revenue without requiring demand to re-accelerate.

- ARB is a hold for now – we’re not selling into this weakness and will await further detail at the February result.