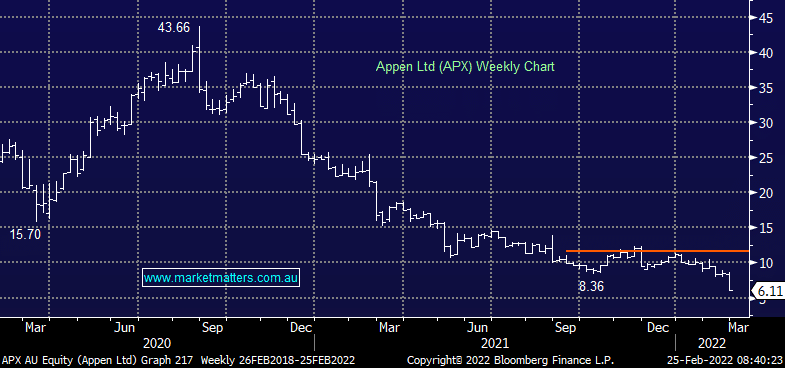

The APX share price was savaged yesterday after their result was a miss and management confirmed low visibility on near term earnings, although they offset that by putting big longer term targets out to the market, considering their ability to forecast earnings over the last few years that doesn’t bring with it any confidence and even if they prove correct it’s going to require some concrete numbers to regain investors’ confidence. MM got this one very wrong and our only solace is we took a small position and only entered after the stock had already plunged over $30 (orange line on chart) – we’re sorry to any subscribers who joined us on the painful journey, while its part of investing its never fun to be so emphatically on the wrong side of a stock.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

JB Hi-Fi (JBH) historical PE multiple – source Bloomberg

JB Hi-Fi (JBH) historical PE multiple – source Bloomberg

Close

Close

MM is now neutral APX, at best

Add To Hit List

Related Q&A

Appen Ltd (APX)

McMillan Shakespeare Ltd (MMS)

NEC and APX

Appen and Nuix

MCMILLAN SHAKESPEARE LIMITED

Appen Ltd (APX)

Thoughts on MMS?

Pullback on MMS and SIQ

Thoughts on Appen (APX) and CSR

Thoughts on mff

MMS view going forward

Sigma and Chemist Warehouse merger

Any thoughts on Meteoric Resources (MEI)?

Thoughts on MMS and SIQ share price movements

MM call to ‘Cut Losers’ like MFG, KGN, APX

Does MM prefer MMS or SIQ?

Updated view on few battered up stocks?

Appen (APX)

New CBA Hybrid + APX & CSL

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

chart

JB Hi-Fi (JBH) historical PE multiple – source Bloomberg

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.