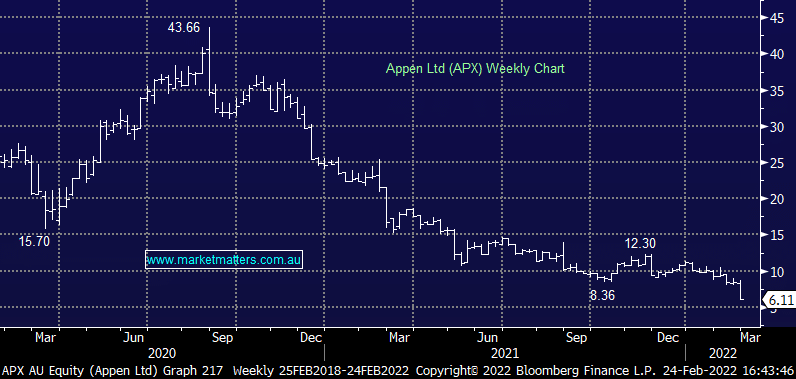

APX -28.70%: This has been a polarising stock in recent times with some analysts forecasting downgrades while others doubled down and increased their conviction on the buy side, today the stock fell ~30% after missing FY21 earnings expectations and pulling FY22 guidance, in favour of longer term revenue targets which were big, a lot bigger than anyone in the market expected, however FY26 is a long way out into the never never. We were hopeful of a better outcome today but alas, the bearish camp led by Macquarie were right, and the stock fell hard. On the conference call it was clear that only analysts with a positive stance on the stock were engaging – Barrenjoey who had a buy equivalent and $15.40 PT remains optimistic as were Citi & Jeffries. While I got off the call thinking that Appen does have a good future, the next couple of years are going to be challenging, their visibility on the business is simply not there and that’s a function of their customers (big US tech mainly) going through rapid changes – hence why they have scrapped shorter term guidance. We had a 3% position in APX in the Flagship Growth Portfolio which we cut for a loss.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Buy Hold Sell: The best and worst performers of FY25

Buy Hold Sell: The best and worst performers of FY25

Close

Close

Tuesday 15th July – Dow up +88pts, SPI up +51pts

Tuesday 15th July – Dow up +88pts, SPI up +51pts

Close

Close

MM is now neutral APX, cutting the position from our Growth Portfolio

Add To Hit List

Related Q&A

McMillan Shakespeare Ltd (MMS)

NEC and APX

Appen and Nuix

MCMILLAN SHAKESPEARE LIMITED

Appen Ltd (APX)

Thoughts on MMS?

Pullback on MMS and SIQ

Thoughts on Appen (APX) and CSR

Thoughts on mff

MMS view going forward

Sigma and Chemist Warehouse merger

Any thoughts on Meteoric Resources (MEI)?

Thoughts on MMS and SIQ share price movements

MM call to ‘Cut Losers’ like MFG, KGN, APX

Does MM prefer MMS or SIQ?

Updated view on few battered up stocks?

Appen (APX)

New CBA Hybrid + APX & CSL

Relevant suggested news and content from the site

Video

WATCH

Buy Hold Sell: The best and worst performers of FY25

James Gerrish & Henry Jennings

Podcast

LISTEN

Tuesday 15th July – Dow up +88pts, SPI up +51pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.