ANN +8.85% jumped after the medical glovemaker forecast better than expected earnings per share (EPS) for the year ahead of $1.07-$1.27, ahead of consensus, largely driven by lower operating costs.

- Adjusted EPS of $1.055 vs $1.153 yoy.

- Final dividend of 21.90c per share.

- Net income of $76.5mn, down -48% yoy, but ahead of estimates of $70.6mn.

- Revenue is $1.62bn -2.2% yoy, estimated at $1.62bn.

- Ebit $195.5mn, -5.2% yoy.

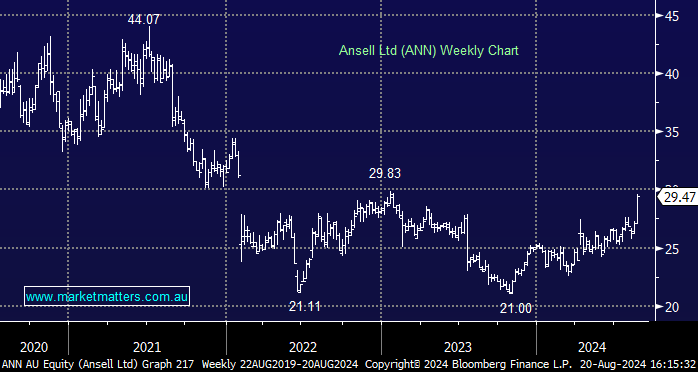

ANN’s FY25 Ebit is expected to improve due to increased sales and higher savings from the Accelerated Productivity Investment Program, although it sees a small earnings headwind from higher raw material and freight costs. ANN looks to have turned the corner, but with the share price already up ~40% from its 2023 low, the risk/reward is only “okay.”