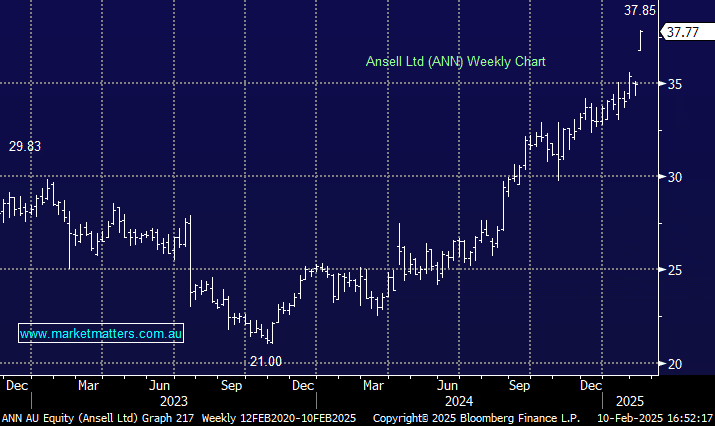

ANN +8.13%: moved to a 3 year high as the personal protective equipment (PPE) provider delivered strong 1H revenue and upgraded its FY25 earnings guidance.

- 1H revenue of $1.02bn, up 30% yoy

- 1H EBIT of $127.4m, up 63% yoy

- FY25 underlying EPS guidance increased to US118c-128c ~ 5% above consensus

- Reaffirmed capex guidance of A$60-$70m

The business expects continued organic sales growth in the H2 through existing business segments however did include commentary around muted demand conditions in manufacturing markets and growth in healthcare slowing. A concern for Ansell is the impact of tariffs given the company generates ~40% of revenue in North America. The majority of production occurs in Asia, however management advised pricing arrangements are in place to offset any tariff risk, so we see the business as well poised for the next half and beyond.