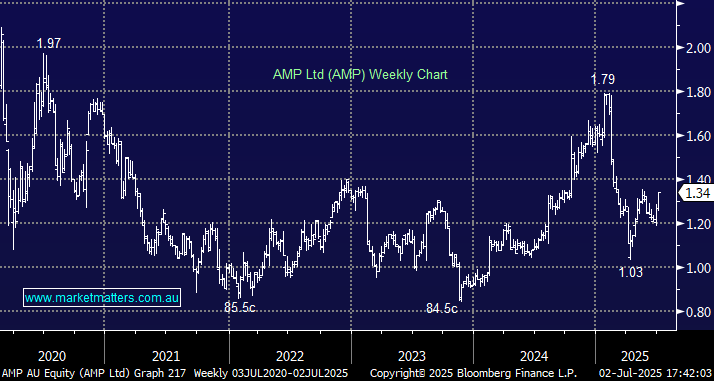

AMP has burnt many Australian investors over the years, if they could do it wrong they have, the stock was trading above $30 in the 1990’s! Rising markets will lead to earnings upgrades but we want to see more operational wins although the stock is looking more interesting as an FY26 story given the likes of reduced wealth outflows, digital SME bank driving lower funding costs, and divestments being recycled into capital management. AMP is currently trading at a 23% discount to its five-year historical average valuation, but due to its history, it’s a stock that investors will give no leniency to if it puts another foot wrong, as we saw in the first quarter, when they lost confidence in its turnaround story.

- We can see AMP testing above $1.50 over the coming months, or 12-15% higher, but it’s not for the fainthearted.