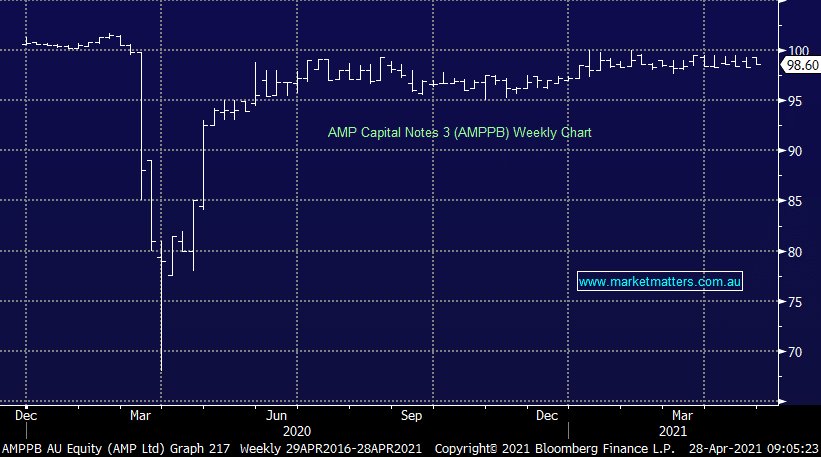

The MM Income Portfolio holds the second AMP hybrid – the AMPPB which at time of issue was launched with a 4.5% margin over the 90 day bank bill with first call date on the 16th December 2025. A lot has been happening at AMP, including failed takeovers, failed asset sales and now one of our other portfolio holdings – Dexus (DXS) is looking to take over the management rights to AMPs Capital Diversified Property Fund – so what does all this mean for AMP and specifically our position in the hybrid which is trading around its $100 face value?

As it stands now, the head company AMP Limited (AMP) has decided to demerge AMP Capital which is the jewel in the crown. This comes after the proposed sale of 60% of this business to Ares Management for $1.35 billion fell over. That business will be rebranded and manage around $50bn of assets while the traditional AMP brand which we have exposure to as hybrid holders will be a retail focussed business with wealth management, investment and banking.

As hybrid holders we need to think about the deal from a credit perspective and at this stage, it’s hard to tell what the actual result will be in terms of the balance sheet as detail was thin on the ground, however what’s clear is that the ‘new AMP’ will be without the earnings grunt and diversity offered via AMP capital, although they plan to retain a 20% stake. It’s also uncertain how costs (and capital) will be distributed across the group at a time when the core AMP business is going backwards.

There are simply too many risks here for the upside being offered on the Hybrids and for that reason we are planning to sell