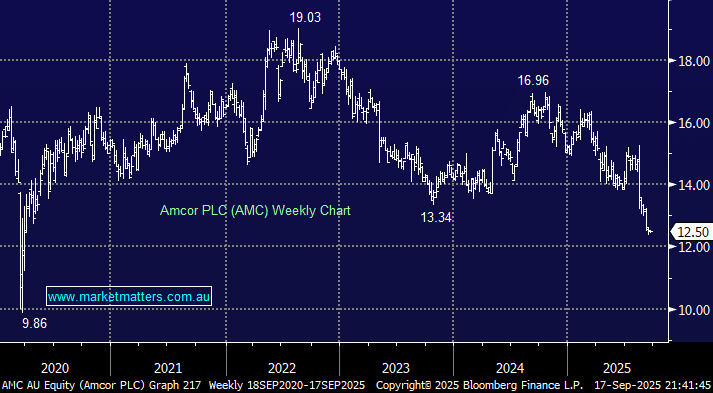

This global packaging company has struggled for a few years, including falling by over 16% year-to-date. There have been a few issues weighing on AMC:

- Weak organic growth – volumes are flat to modestly higher, with some rigid packaging segments in decline.

- Margin pressure – higher input costs, FX headwinds, and integration expenses are weighing on profitability.

- Demand softness – weaker consumer spending, particularly in North America, is dragging on sales.

- Integration risk – successful delivery of its major $8.4bn Berry Global merger remains uncertain.

Amcor’s peers are also grappling with subdued consumer demand in North America and margin pressure from cost inflation and supply chain challenges, leaving the broader sector struggling in the post-COVID environment. While AMC’s own performance has been mixed, its scale and recent acquisition provide opportunities to leverage synergies. The key risk lies in executing on those synergies and preserving profitability as market conditions soften. Market conditions are clearly tough, although they are cyclical more than structural for AMC.

The successful integration of Berry Group is pivotal to the next chapter: the all-stock acquisition saw Berry shareholders receive 7.25 AMC shares. The deal is expected to deliver benefits of about US$650 million annually by FY2028, including cost savings, growth benefits, and financial efficiencies. The merger is likely to have led to some selling of AMC stock by previous Berry shareholders, helping to weigh on the Australian buyer, which is now trading on just 10.3x FY26 earnings, ~28% below its usual level. There’s a lot of bad news built into the AMC share price, with a forecast ~6% yield over the next 12 months, useful for patient investors.

- We like AMC for a relatively cheap mix of defensive and cyclical exposure, but note it does remain out of favour at present – it’s now in our Hitlist as a stock to watch.