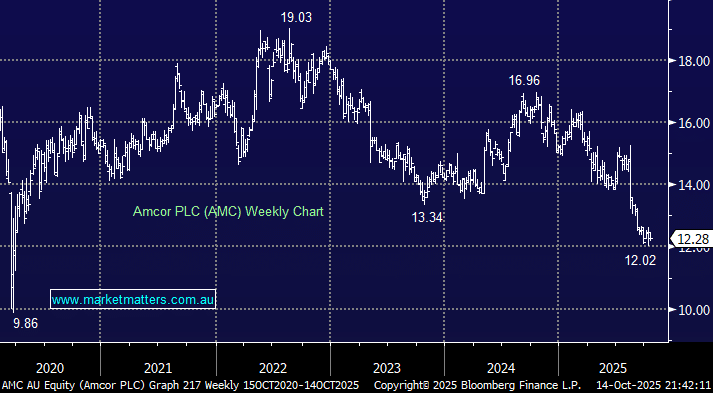

We covered Amcor recently as an interesting, deep value turnaround opportunity, though noting it had some near-term earnings challenges. Late last week, AMC shares found some better footing, with the stock bouncing modestly following the appointment of a new CFO and a reaffirmation of FY26 guidance. While the packaging company remains out of favour, we view it as a defensive name trading at undemanding levels — one that could quietly rebuild momentum through operational discipline and merger execution.

Amcor announced the appointment of Stephen Scherger as Executive Vice President and Chief Financial Officer, replacing long-time CFO Michael Casamento. Importantly, they also reaffirmed both its Q1 FY26 and FY26 guidance alongside the announcement — EPS of US$0.80–0.83 (consensus 81c) and free cash flow of US$1.8–1.9bn.

Fundamentally, not much has changed since our last update. Amcor continues to grapple with weak organic growth, cost inflation, and subdued consumer demand across North America, but the reaffirmation of earnings guidance does take the risk of a downgrade off the table for the next few months. They also confirmed decent cash generation, with FY26 free cash flow tracking close to US$1.9bn, at the top end of guidance, which supports an attractive ~6% dividend yield.

Worth noting, though, that given they are domiciled in Switzerland (it redomiciled from Australia in 2019 after merging with Bemis), dividends are paid in US dollars and do not carry Australian franking credits. Instead, Amcor typically pays a quarterly unfranked dividend, which is subject to foreign withholding tax (usually 15%) depending on your tax residency and how your broker handles it.

- In practical terms, much like GQG Partners (GQG), Australian investors receive the dividends as unfranked foreign income for tax purposes — so we can’t claim franking credits but can generally claim a foreign tax credit for any withholding.

Trading on around 10x FY26 earnings, AMC remains cheap relative to its own history (typically closer to 14x) and peers. The balance sheet looks solid, and the Berry merger offers meaningful potential. We continue to see AMC as a patient investor’s story — defensive, cash generative, and undervalued, but lacking a near-term catalyst until integration progress or earnings momentum improves.

- There is a lot of bad news already priced in, and we think AMC is a buy, particularly as we scour the market for some unloved opportunities to recycle capital from stocks that have run hard.