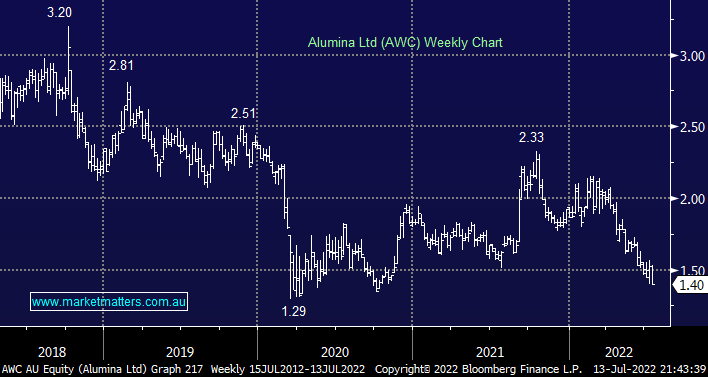

AWC failed to enjoy a surging commodities market in Q1 but it’s had no problems jumping on board the savage resources correction over the last few months, the stock made fresh multi-month lows yesterday taking it down another -25% year-to-date. Something still feels wrong here as we keep reminding ourselves to “don’t fight the tape” which for AWC continues to point downwards. The stock may still look cheap trading on a sub 10x for 2022 while it’s forecast to yield ~7.5% over the next 12 months, but the trends are all going lower at the moment.

- The are a number of Australian resources plays which MM prefers to AWC.