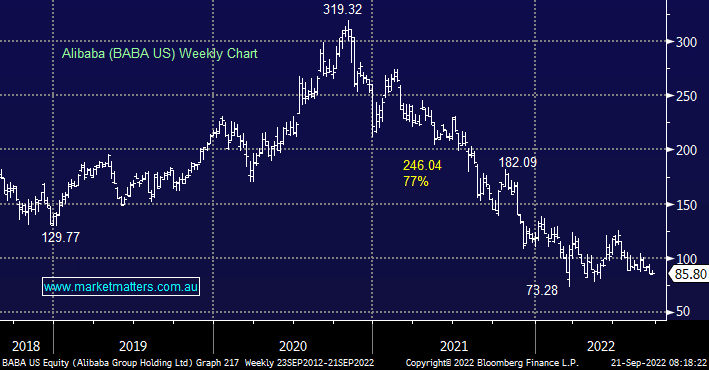

On the Market Matters Website, the company page for Alibaba (BABA US) shows a consensus price target of $152.86 (80% upside from current levels), with 42 buys, 3 holds & 2 sells. The market collectively believes BABA is deeply undervalued and should be trading at significantly higher levels. In recent days we’ve met with Mark Landau from L1 Capital and attended a webinar with Phil King from Regal, both managers sighted Alibaba as a stock they are buying now. So, with the stock down 45% over the past year what (if anything) should we be doing with our position in BABA which is deeply underwater?

The stock has been hurt by Chinese lockdowns and a move out of emerging markets given the rising $US and higher interest rates. The clear move away from high-growth / highly-priced technology would have also hurt Alibaba given it resides in many of the ETF’s exposed to this theme, although BABA itself is certainly not highly-priced trading on an Est PE of 11.75x while delivering growth in excess of 10%. We think looming stimulus from China will help sentiment towards China-facing equities, a peak in the $US & bond yields could be close, and we continue to see deep value in Alibaba below $US90.