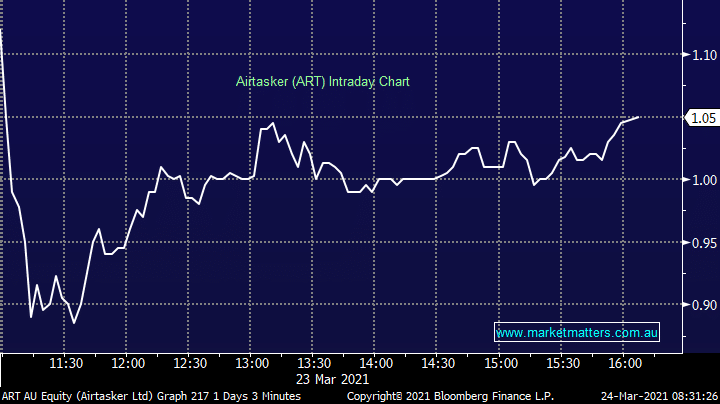

A very strong debut yesterday on the ASX with the stock up ~70%. This is a very good business that is highly scalable particularly as they venture overseas, the only sticking point for the MM Emerging Companies Portfolio at the moment is price. For those not familiar, Airtasker was started in 2012 essentially as an online market place for labour. When we got the kids a trampoline for Christmas a few years ago, we had a ‘Tasker’ as they are called come and put in together. Good for the marriage and for the hip pocket!

The chart below from Morgan’s look at GMV, or in other words, the value of services being sold through the platform. This shows 1. Good growth 2. The COVID dip & 3. The resumption of the uptrend after restrictions were eased.

While only early days , this trend has led to strong revenue growth of 24% in FY20 with a forecasted 27% growth into FY21, even with the COVID impact. Revenue in FY21 is expected to be to be around $26m generated from their 950k customers and 150k taskers. The average spend on each task is also increasing nicely and now sits at $159 and is forecast to go to $189 in FY21.

As MM we alluded to above, revenue around $26m in FY21 puts the stock on a revenue multiple of 15x which is clearly very expensive.