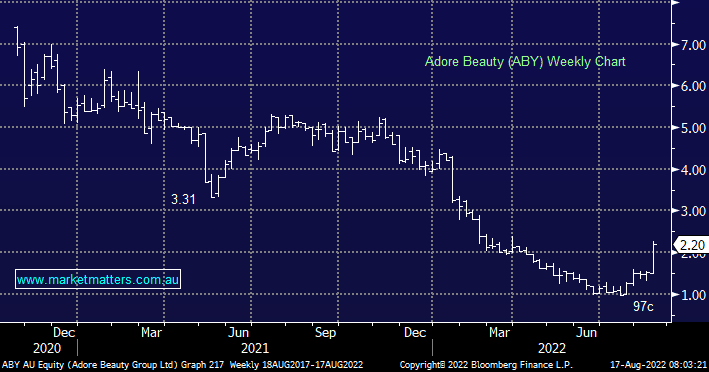

The online beauty products retailer rallied yesterday and shares are now more than double the June lows despite CEO Tennealle O’Shannessy announcing her resignation last week (moving to IDP Education). The stock added to the rally yesterday, jumping 30% on the back of a strong result from eCommerce peer Temple & Webster (TPW). While not playing in the same products, there are plenty of similarities between the two. Adore hasn’t provided a 4th quarter update, so drawing on the 9 months to March, the market expects final quarter revenue of $46m to hit the $201.8m expected. EBITDA margins for the half year were 3.3%, and the company has guided to 2-4%. The market sits at the lower end of the range, around 2.5%, however, Temple & Webster proved margin expansion is possible again, printing 3.8% and at the top of their guidance range. Adore has been working on improving margins, particularly through a focus on private label products which it launched late in the year. We suspect that margin expectations are conservative at the moment, so a strong result will rely on sales when they report on the 29th of August. We believe a new CEO is a good thing for ABY which has clearly struggled since its listing.

scroll

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM is bullish ABY

Add To Hit List

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.