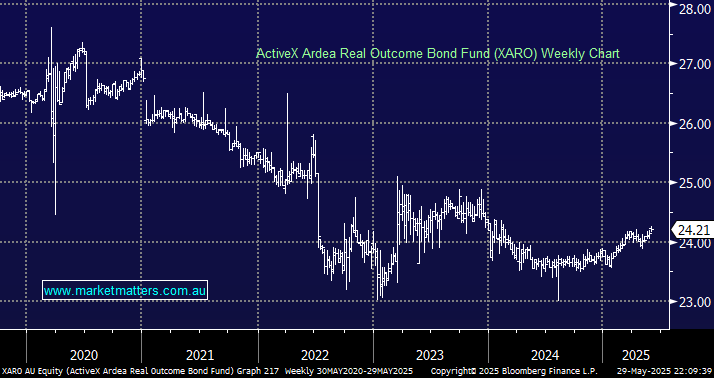

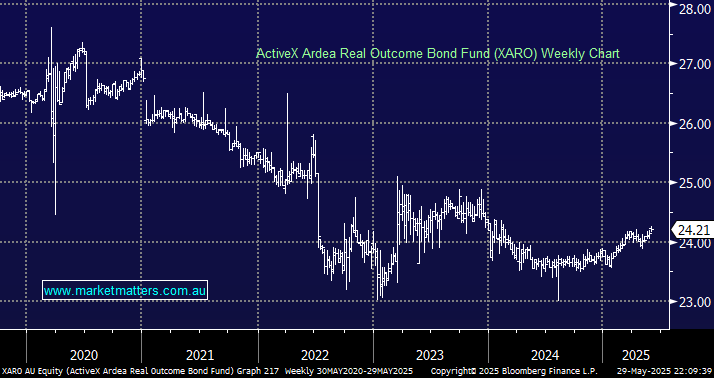

This is a security we’ve held in the past (in the Income Portfolio) used to gain fixed income exposure without taking on what is called duration risk. This is a highly differentiated strategy where returns are not impacted by whether bond yields are high or low and regardless of whether interest rates are rising or falling. It’s very low volatility, but also low return.

They invest in a global portfolio of high-quality government bonds, prioritising capital preservation and liquidity. XARO is a very low-risk fund benchmarked against the Consumer Price Index (CPI) to target a return above cash and inflation.

- Advantage: distributions are paid quarterly, which equates to a 2.5% return over the last 12 months, but returns of 3-4% is what should be expected over time.

- Disadvantage: This is a low-risk ETF with a nine-year track record and significant funds under management.

We are neutral XARO for now, we would like it when we want safety and protection, which is not today.