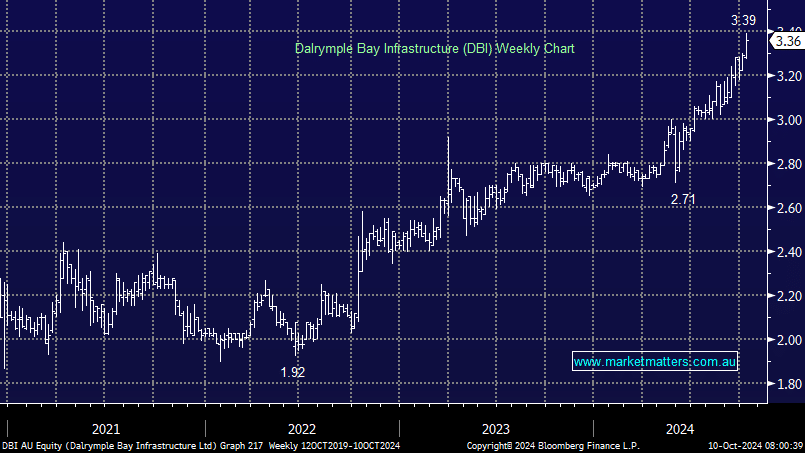

We are stepping up and buying defensive infrastructure company DBI. We were hoping to pick the stock up nearer $3.20, however we missed that level. We have elected to ‘pay up’ given the strong trend playing out in the stock. DBI yields ~7%, 60% franked.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM are buying DBI in the Active Income Portfolio, allocating 4% around $3.36

Add To Hit List

In these Portfolios

Related Q&A

Thoughts on Dalrymple Bay Infrastructure (DBI) and Sigma Healthcare (SIG)

What is happening with Dalrymple Bay Infrastructure (DBI)

Coal stocks and related companies

Your view on various stocks

Thoughts on Dalrymple Bay (DBI) for yield

Does MM like Dalrymple Bay Infrastructure (DBI)?

DBI & PPS, MM thoughts

DBI & PDL – MM’s take

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.