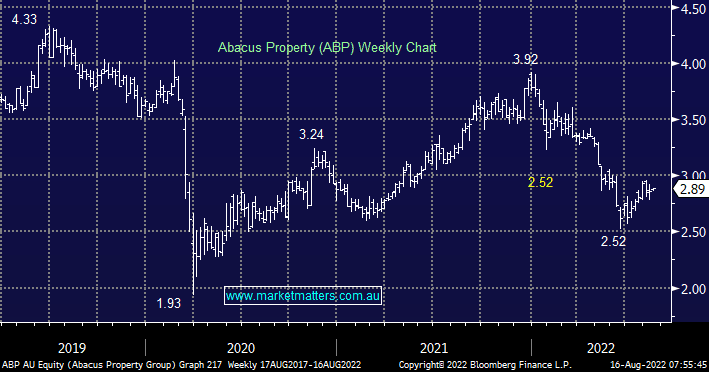

ABP is a diversified property investment group that provides exposure to a portfolio of commercial office space and self-storage real estate, the stock is reasonably priced trading on an estimated PE of 14.6x for 2022 while it’s expected to yield 6.4% over the next 12 months. ABP reports results today so we will get a better handle on this then, however, we still have a preference for National Storage (NSR) in the storage space and the market clearly agrees as the stock struggles to bounce thanks to its exposure to office, and to a lesser degree, retail.

- We see no reason to chase ABP around $3 believing fresh 2022 lows could easily unfold on higher bond yields.