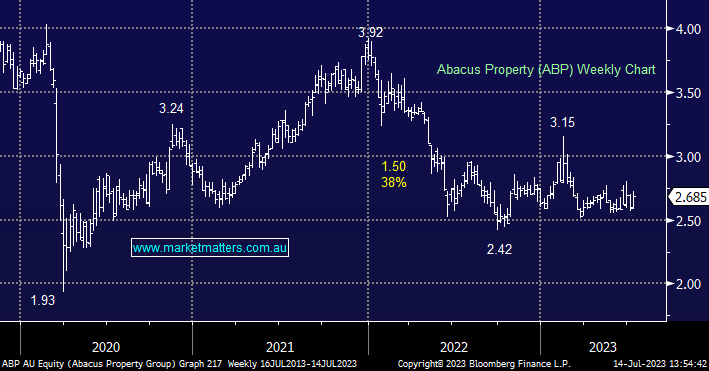

Abacus / Storage King split – which bit is the most valuable?

Hi I currently hold ABP shares (based on MM's analysis & opinion and doing quite nicely thank you) and have received details about the proposal to spin off the Storage King assets as a separate entity. If we assume that it goes ahead then current ABP holders will receive the same number of shares in ASK as they hold in Abacus (although you can apply for additional ASK shares) Which of the two new separate entities do you think would have the most value after the spin-off - Storage King or the office/retail assets that would be left in Abacus? Would you continue to hold on to both? Cheers, Carl