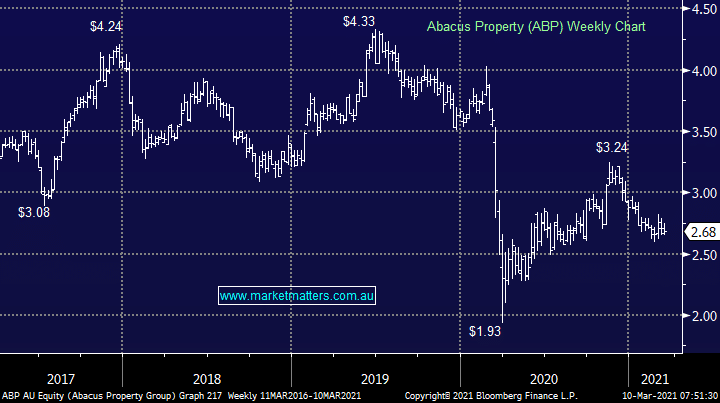

ABP has been a weak performer in this portfolio with returns underwhelming us to date. While the stock remains undervalued relative to its assets, there are plenty of property stocks listed that fall into this category and we need to be focussing our efforts in the areas that we believe will have the best returns from here. Abacus (ABP) has a strategy of acquiring high quality self-storage assets and after having raised capital, has room to spend around $600m before gearing reaches 30%, however finding opportunities to deploy this capital seems to be tough going. This lack of investment is prompting MM to think about our holding with the view of switching it to Dexus Property Group (DXS), a stock we’ve covered in recent notes (and included below). Valuations are up on self-storage assets and ABP are left with too much powder unspent here. We believe DXS has more upside than ABP.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM is considering cutting Abacus (ABP) for the loss with the view of switching into Dexus (DXS).

Add To Hit List

Related Q&A

Abacus / Storage King split – which bit is the most valuable?

Does MM like Abacus Property (ABP) into the company split?

Could you update your views on ABP & MTS

Does MM like ABP & TLG?

What are MM’s thoughts on ABP’s SPP?

Thoughts on ABP

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.