- What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

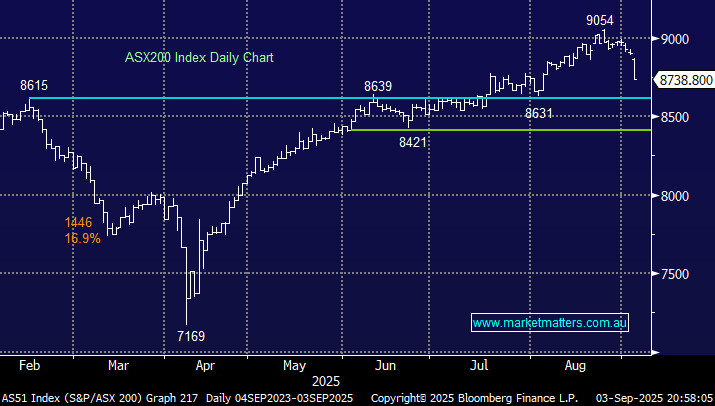

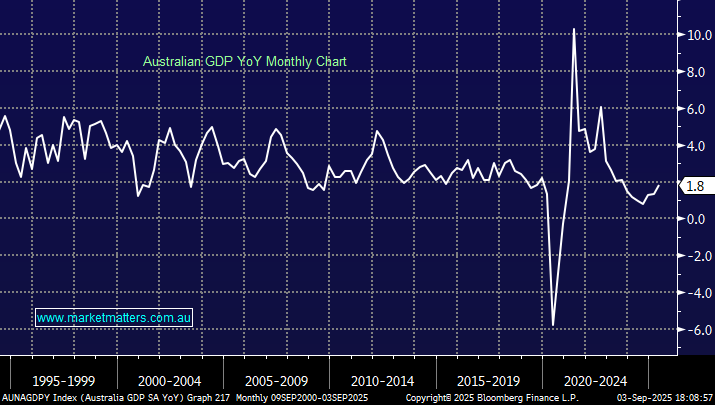

The ASX200 hit a buyers’ air pocket on Wednesday, leading to its worst day in 5 months when a weak session on Wall Street combined with a strong local GDP print of +1.8% year on year, above the 1.6% expected by economists. The local economy grew at its fastest pace since September 2023, significantly diminishing the prospects of another rate cut anytime soon. The futures market is now pricing in one cut before Christmas, and probably another in the next 12 months. All 11 major ASX sectors retreated, but the rate-sensitive Tech, Financials, Real Estate, and Utilities dominated the losers enclosure.

- Losses were compounded on Wednesday by the likes of Whitehaven (WHC), Netwealth (NWL), Ramsay Health (RHC), Pro Medicus (PME), Evolution Mining (EVN), Seek (SEK), and Newmont (NEM), all trading ex-dividend.

After yesterday’s ~160 point/1.8% plunge, investors are starting to believe in the seasonal misery September usually delivers. However, with reasonable cash levels across most MM portfolio’s, we are more focused on what/where to start deploying funds. Hence, we’ve delved into what usually unfolds through September/October before the buyers return:

- Over the last decade, the ASX200 has fallen 80% of the time in September and 60% in October; the largest loss for a September over the last decade is 5.9%; we’re already at -2.6% in 2025!

- The average loss in September is ~2.3% while October has delivered a net positive outcome, albeit with some significant +/- 6% swings in both directions.

- Interestingly, the best performances in October came in bullish years; in other words, buyers returned after sharp declines – this fits the profile of 2025.

After yesterday’s downward acceleration, our buy/accumulate areas, at least on the index level, are coming into sight faster than expected – generally the case when markets decline. We are looking for a test of 8600, although a test of 8450 cannot be ruled out.

Overseas markets improved overnight following a weak jobs report in the US, which saw traders almost fully price in a Fed cut this month. In Europe, the EURO STOXX 50 closed up +0.6% while the UK FTSE advanced +0.7%. In the US, it was a more mixed affair, with the NASDAQ bouncing +0.8%, led by a +9.1% surge by Alphabet (GOOGL US), while the Dow closed marginally lower.

- The SPI Futures are calling the ASX200 to open up +0.4%, regaining around 25% of yesterday’s decline with a 40c gain by BHP set to help on the day, though it does trade ex-dividend for 92c.

Stronger-than-expected GDP figures saw local interest rate cut bets dialled back on Wednesday. The Australian economy grew by 0.6% in the March quarter and 1.8% over the past year. Household spending, especially on hospitality and travel, was a key driver of growth. The savings rate fell following interest rate cuts in February and May, as households opened the purse strings on more non-essential purchases. Markets still ultimately expect the RBA to cut rates down to a pivotal rate of 3.10%. However, at this stage, with employment strong and inflation still bubbling below the surface, this is the best-case scenario in our opinion unless the economy slips into reverse.

- Futures markets are only looking for one more 0.25% rate cut before Christmas, either in November or December.