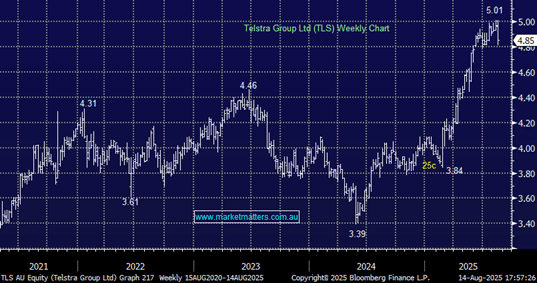

TLS –2.61%: fell today after posting FY25 results that met expectations but fell slightly short on weaker mobile user metrics.

- Revenue of $23.12 billion vs $22.93 billion y/y

- Earnings of $8.62 billion vs $8.24 billion y/y

- Final dividend of 9.5 cents per share vs 9cps y/y

As we’ve iterated, just meeting expectations hasn’t been enough in recent results seasons and that showed again today for Telstra. It wasn’t a bad result by any means though, with the telco continuing to demonstrate strong capital management with cost-outs coming from the divestment of their Versent stake to Infosys due to complete in 2026 and reiterating their target of 10% ROIC by FY30.

After completing a $750 million buyback last month, management announced another $1 billion in on market buybacks which should be supportive of the share price, but after the recent run up in the name we wouldn’t be surprised by further near-term softness.