- What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

- Market Matters Reporting Calendar: Australian FY25 Reporting Calendar in PDF Here & Spreadsheet Here

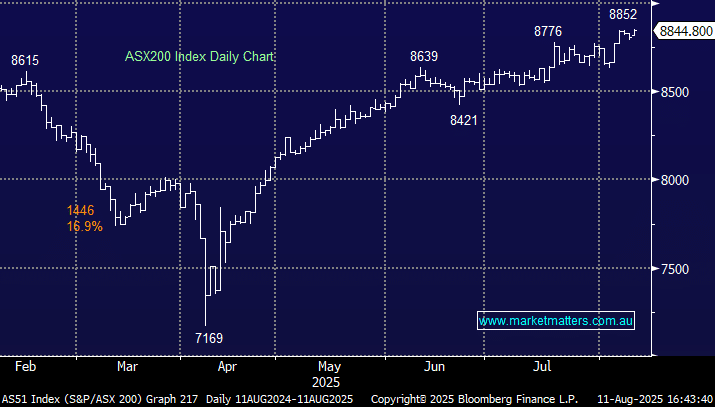

The ASX200 closed up +0.4% on Monday, driven to new highs by a resources sector enjoying a new lease of life; it’s already surged +6.7% so far in August. The lithium stocks led the charge following the news that CATL shut down one of the world’s largest mines, but on the index level, it was BHP that added the most points, around 30% of the day’s 38-point gain. Outside of the gold stocks, the Materials Sector was hot, from lithium to copper, and iron ore:

Miners: Pilbara (PLS) +19.7%. Mineral Resources (MIN) +12.2%, Capstone Copper (CSC) +5.3%, Fortescue (FMG) +3%, South32 (S32) +1.7%, BHP Group (BHP) +1.6%, RIO Tinto (RIO) +1.5%, and Sandfire (SFR) +1%.

Only 53% of the main board closed higher on Monday, but all the big names delivered, sending the index within 2% of the psychological 9000 level. As we roll through reporting season, we expect plenty of volatility on the stock level, just as we saw from JB Hi-Fi (JBH) yesterday – the major retailer traded in a whopping ~12% range, surrendering early gains to close down 8.4%. The JBH result was good, but not good enough with the stock up +35% year-to-date coming into the numbers, especially when it was accompanied by the news that CEO Terry Smart was looking to retire.

- Investors must consider not just a company’s earnings this season but also the weight of expectations i.e. are the momentum traders all long?

The RBA is expected to cut rates by 0.25% today, with futures markets pricing in a greater chance of a 0.5% cut than no cut at all. However, assuming the central bank doesn’t spring another surprise and we see a 0.25% cut at 2.30 pm, Michelle Bullock’s accompanying rhetoric will determine how the rate-sensitive stocks are likely to travel through August and September.

Overseas markets were broadly weaker overnight, even though President Trump extended the China tariff truce for another 90 days. The EURO STOXX 50 and German DAX slipped 0.3% in Europe while the UK FTSE gained 0.4%. In the US, the S&P retreated 0.3% and the tech-based NASDAQ 0.4%.

- The SPI futures are calling the ASX200 to open down 0.1% this morning, ahead of the RBA decision, with BHP up a few cents in the US.