- What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

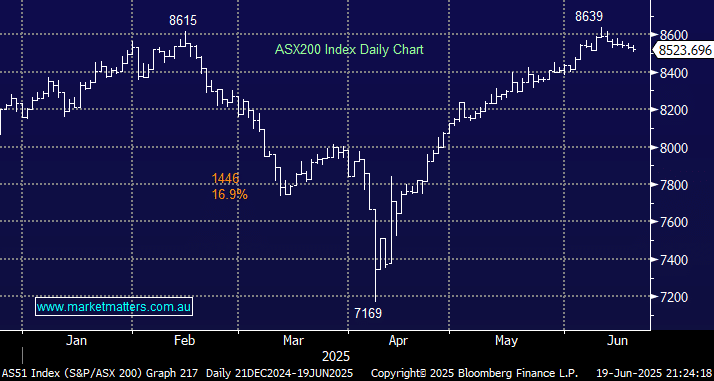

The ASX 200 slipped another 0.1% on Thursday, with the song remaining the same on the stock & sector level. CBA scaled new highs, trading through $183, while weakness in the large-cap iron ore miners was enough to ensure the index closed mildly lower. The local market has begrudgingly retraced 1.3% over the last seven trading days. We thought June might see a choppy pullback, but even we expected more action than the current slumber, especially considering the geopolitical and macroeconomic backdrop. With the EOFY only 10 days away, it feels like some classic window dressing and tax loss selling might be slowly starting to unfold.

The “risk-off” sentiment that’s prevailing at present makes sense with traders concerned about the possibility of US direct involvement in the conflict between Israel and Iran, with senior US officials preparing for a potential strike on Iran. However, the fact that the index has only surrendered a small portion of the bounce from its April low reaffirms our view that if it manifests itself into a more meaningful dip, it’s one we would like to buy.

The gold stocks again took much of the brunt of the markets’ selling, even though the precious metal has only retreated by less than 4% from its late April high. A great example of a crowded trading unwinding as the momentum turns:

- Evolution (EVN) declined another 4.5%, extending its pullback from its early June high to 21%. We will consider adding to our position in the gold producer around the $7.50 area, or 4% lower.

- Regis Resources (RRL) fell 1.1%, extending its pullback from its early June high to 19%. We will also consider the gold producer around the $4.25 area, or 8% lower.

US stocks were closed overnight for Juneteenth National Independence Day. Still, the futures were trading electronically, and the S&P 500 fell almost 1% after Trump’s comments that he would decide whether to attack Iran in the next two weeks offered some short-term clarity but did little to resolve broader uncertainty around potential US involvement and the risk of renewed energy-driven inflation. Markets were also lower in Europe; the EURO STOXX 50 closed down 1.3%, and the UK FTSE 0.6% as they went into wait-and-see mode.

- The SPI Futures are calling the ASX200 to open down 0.3% this morning in line with falls on global markets.