Nufarm (NUF) share price plummets on first half issues

Stock

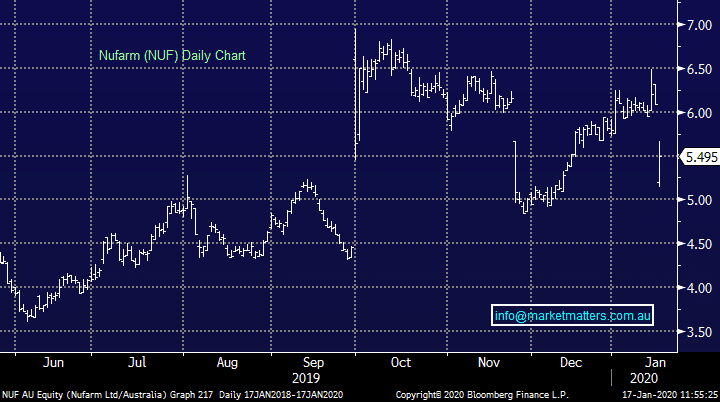

Nufarm (NUF) $5.40 as at 17/01/2020

Event

Nufarm has been forced to lower the market’s expectations for the half year result today with shares coming off more than 10% as a result. The company flagged issues – particularly in North America and Germany - in November, but was today able to give a more refined look at how tough the first 6 months have been. They guided to EBITDA of $55-65m in the half, around half of 1H19 and 30% below the market’s expectations.

Each of the company’s geographies will see earnings fall. In South America, sales are growing but margins are being squeezed by competition, while costs are also up as they prepare to launch new products. North America’s weak crop demand seen in the first quarter flowed into the second and sales have remained subdued as a result. Raw material costs and competition increases in Europe will roll the segment into a loss for the first half. Sales and logistics investments will also increase costs into the second half as well.

Australia & New Zealand’s extreme weather conditions have caused Nufarm’s sales to suffer, although the company is looking for a better second half here as performance improvements continue to lower their cost base. The result out of Asia has also been hampered by weather, as well as higher inventory levels causing delays new orders.

The clear theme above is that the company is looking for operations to rebound into the second half, but a big 20/80 skew was already baked in prior to this announcement. If the same skew was overlayed on a first half EBITDA of $60, Nufarm might be able to edge $300m for the full year, 37% below current consensus.

Nufarm (NUF) Chart

Market Matters Take/Outlook

Market Matters Take/Outlook