Nothing normal about Harvey's result (ASX:HVN)

Stock

Harvey Norman (ASX:HVN) $3.66 as at 31/08/2018Event

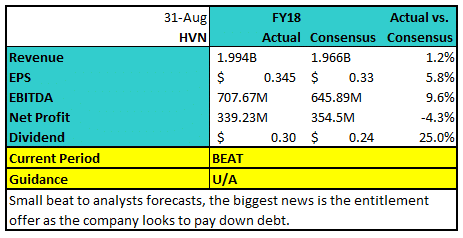

The retailer announced FY18 numbers this morning packed with plenty of surprises. The result itself looked positive, especially on an underlying basis stripping out one off impacts with underlying profit at 377M, 6.5% above forecasts. Along with a big dividend taking the total pay out to $0.30 for the year. The result was driven by overseas store and sales growth while impacted by lower property revaluations. A -7.2% fall in franchise income and a $49.44m impairment from the company’s dairy investment Coomboona. The franchise performance was the most concerning aspect here. Coomboona has been written down to zero by the market and Harvey’s property portfolio had a stellar 2017, so was known it would contribute less this year. The short thesis on HVN centres on concerns that franchises are being kept afloat by lower franchise fees and even franchise debts being paid by the head company. While deep discounting has been forced on the franchises to compete with Amazon/JB Hi-Fi/Bing Lee. No real outlook was given by the company, focus has well and truly moved to building the overseas business. The biggest surprise this morning though was the 1 for 17 entitlement issue to raise funds to pay down debt. New shares are to be issued at $2.50, a huge 32.4% discount to yesterday’s close. Harvey Norman’s debt has crept higher over the past few years, up almost 47% from $514m in 2016 to $754m this year, which has seen the net debt to equity ratio rise from~19% to 25.5%. Although this is not a stressful level of debt, the business is clearly trying to grow and will continue to need capital to do so over the next few years. It does seem fishy though that the dividend can rise 15% but an equity raise is still required - the final dividend of 18c/share is more than the company could raise with the entitlements ($2.50 for 17 shares = 14.7c/share). Perhaps they’re being smart by getting rid of franking credits now, while investors can still utilize them, including Gerry himself!

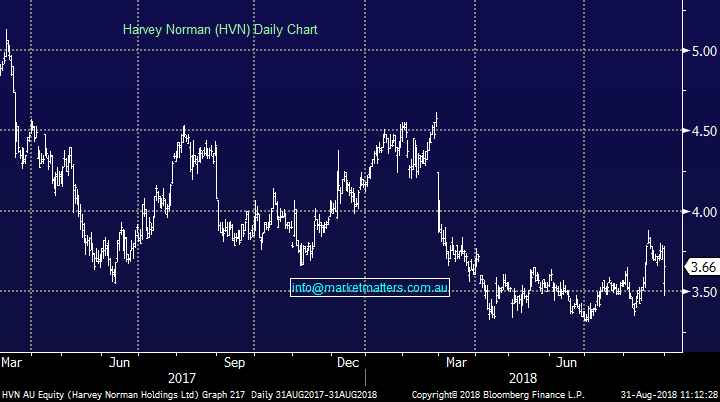

Harvey Norman (HVN) Chart

The biggest surprise this morning though was the 1 for 17 entitlement issue to raise funds to pay down debt. New shares are to be issued at $2.50, a huge 32.4% discount to yesterday’s close. Harvey Norman’s debt has crept higher over the past few years, up almost 47% from $514m in 2016 to $754m this year, which has seen the net debt to equity ratio rise from~19% to 25.5%. Although this is not a stressful level of debt, the business is clearly trying to grow and will continue to need capital to do so over the next few years. It does seem fishy though that the dividend can rise 15% but an equity raise is still required - the final dividend of 18c/share is more than the company could raise with the entitlements ($2.50 for 17 shares = 14.7c/share). Perhaps they’re being smart by getting rid of franking credits now, while investors can still utilize them, including Gerry himself!

Harvey Norman (HVN) Chart