Not much by the market, but plenty of big moves beneath the surface! (LLC, WOR, A2M)

WHAT MATTERED TODAY

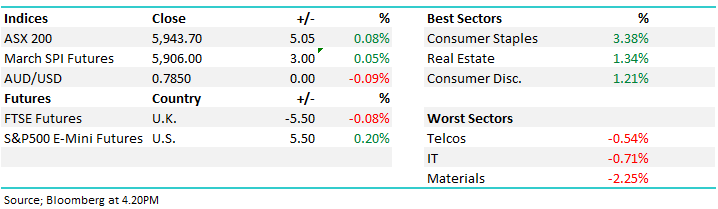

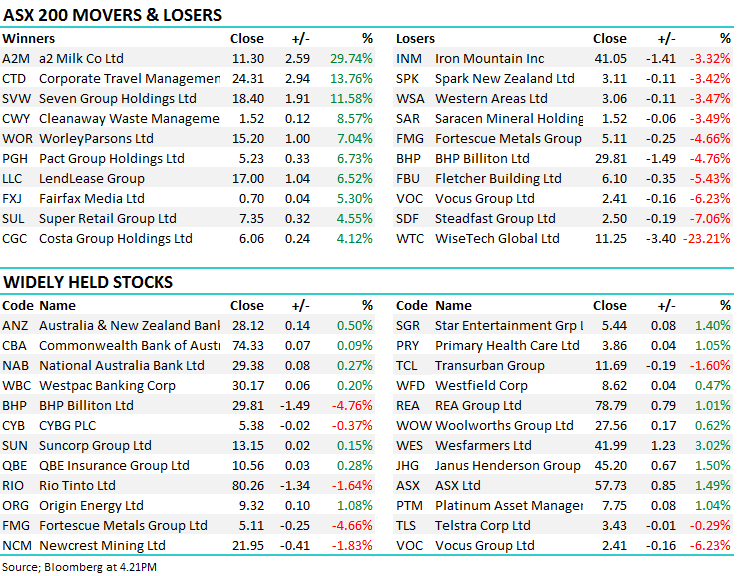

Almost a mirror image of yesterday’s trading day today with the market following the overseas lead lower early, before buyers stepped in with the market bouncing in and out of positive territory throughout the afternoon. Reporting once again dominated today, it was Aussie investors first opportunity at BHP after their lacklustre result last night, FMG reported premarket which disappointed, the stand out for today was A2M which rallied close to 30% after another cracking result – more on that later. Overall, we finished just 3 pts higher, 23 pts from the lows, currently sitting at 5943 & adding just 0.05% today.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

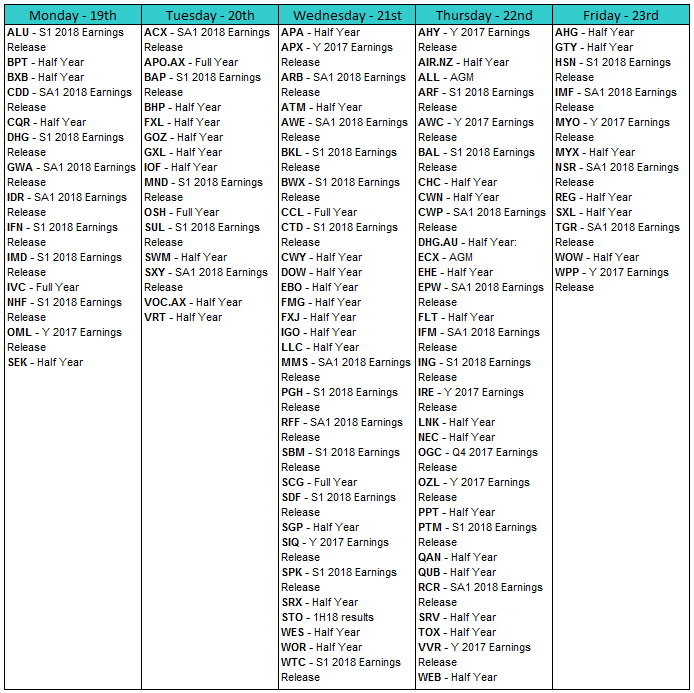

Reporting today…

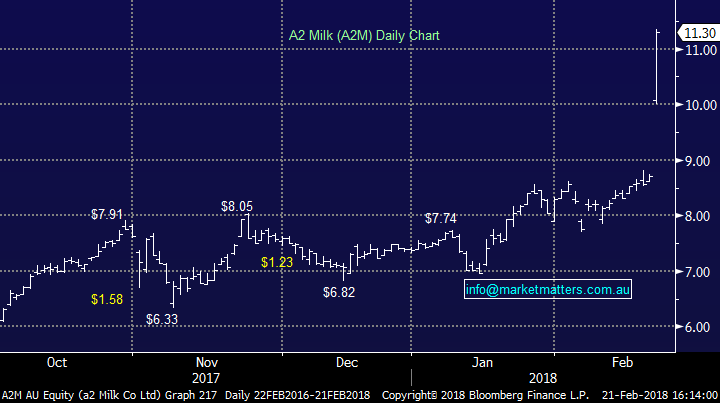

A2 Milk Company Limited (A2M) – rallied hard on the back of a very big beat to earnings – around 20% on our numbers which is significant. Simply a cracking result and no doubt many happy holders in this one today. We got this one wrong, sold too early (made a nice profit but still….) well done to all that still holds. The most impressive result in the reporting season to date. The stock added 29.74% to $11.30. More on this below.

BWX Limited (BWX) – The opposite of A2 missing expectations by about 10% on the earnings line and when you’re a company on a big multiple, have talked a big game, then you need to deliver – BWX didn’t and the mkt punished them today – stock down -31.4% to $4.96.

Coca-Cola Amatil Limited (CCL) – reported a net profit of $416m, pretty much in line with consensus however commentary was better. Probably more a relief rally than anything. Stock added 1.61% to $8.83

Corporate Travel Management Limited (CTD) – reported 1H18 revenue of $172.8m and a dividend of 15c/share – a solid beat + the company looks to be on track to reach the top end of its FY18 guidance. CTD rallied 13.76% to $24.31.

Fortescue Metals Group Ltd (FMG) – They beat 1H18 EBITDA and NPAT consensus by ~2-3% but missed on the dividend / payout ratio, investors sold to stocks as a result. We thought the numbers were actually okay and reaction overdone to the downside – we covered in the Income Report today. FMG closed $5.11, off -4.66%

Independence Group (IGO) – An inline result, much of which was already released in their Dec quarter production numbers out recently - the stock lost -1.23% to $4.80

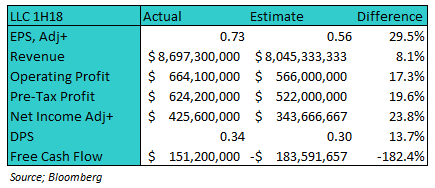

Lendlease Group (LLC) – a strong result. Beat in terms of earnings by a long way however some of the beat was timing related. Still profit ~24% above consensus and an approval for a $500m share buyback is always going to get the buyers out of their slumber. LLC rallied +6.52%, finishing at $17.00. More below.

Scentre Group (SCG) – Their full year numbers were inline, with guidance lower than some estimated – however we don’t track closely. SCG however rallied 1.83% to $3.89.

Stockland (SGP) – also reported inline along with its FY18 guidance being reaffirmed. Dividend of 26.5c/share kept investors happy, with the stock up 2.49% to $4.11.

Santos Limited (STO) – reported above in terms of profit, but below on pretty much everything else, so looking through the windscreen doesn’t look as bright as the picture in the rear view mirror. Markets price the future it’s hard to get excited about STO – they ended $5.02, off -3.09%.

Wesfarmers Limited (WES) – Miss on most headline metrics but underling trends positive in Bunnings (what a cracking business!!) and Coles which did better than the mkt thought they would. We covered in the Income Report today. WES finished up 3.02% at $41.99.

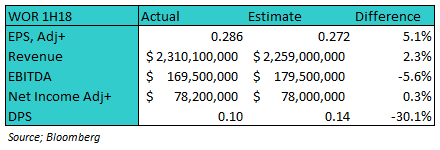

Worley Parsons Limited (WOR) – was in line with consensus however resumed its dividend which the mkt likes – shows confidence at the very least. They’ve been on hold since 2015…WOR closed 7.04% higher at $15.20. More below.

CATCHING OUR EYE

1. Worley Parsons (WOR) $15.20 / +7.04%; A big turn around from 12 months ago for the engineering contractor, swinging from a $2.4mil loss to a $1.4mil profit for the first half of the financial year. Margins were driven higher by cost cutting, helping generate cash flow and giving them the ability to reinstate the dividend policy – WOR hasn’t paid a dividend since August 2015. Investors loved the news, even if the dividend was slightly below expectations (skewed by some very optimistic analysts). The acquisition of UK based AFW was another driver helping push WOR back into the black, the company expects this to skew earnings to the second half showing strong earnings momentum.

Worley Parsons Daily Chart

2. A2 Milk (A2M) $11.30 / +29.74%; A big beat today, and further proof that the growth strategy is continuing to reap rewards over and above expectations. The EBITDA line has more than doubled on pcp, driven mostly by the Asian business tripling. In a content heavy day for A2M, markets brushed the announcement forecasting higher marketing expenses in the second half and focussed on the strategic alliance with New Zealand’s dairy farmer co-operative Fonterra, bolstering A2M’s milk supply, and adding to A2’s distribution network to access untapped markets globally. The new strategic relationship highlights A2 Milk’s continued drive for growth. Obviously hard to watch a stock run so far once selling out (although taking a nice 20% profit in just a few weeks), however we aren’t looking to chase A2M at this stage and expect volatility to remain high providing better entry points.

A2 Milk Daily Chart

3. Lend Lease (LLC) $17.00 / +6.52%; The result beat expectations across the board this morning, particularly at the FCF line which was a strong positive when the market was expecting a negative. This was clearly unexpected from the market, and LLC is now using the cash to launch a $500Mil on market buy back, unlocking value for shareholders. It’s a smart move by LLC and one that shows their thinking in terms of the property market – using cash for a buy back rather than development, LLC seem to think that the property market is a little toppy. The result wasn't all rosy, with construction EBITDA margin falling to 2.7%, below the group’s target range at 3-4%, along with signs of stress within the engineering book with backlogs rising and many projects impaired. A good result, but not an area of the market we particularly like.

Lend Lease Daily Chart

REPORTING THIS WEEK

OUR CALLS

No changes to the portfolio’s today

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 21/02/2018. 5.09PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here