Nickel shaping up nicely, Western Areas (WSA) strike concentrate

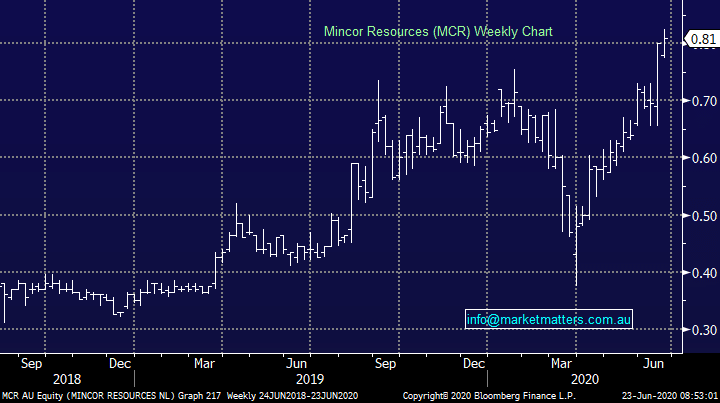

Western Areas (WSA) +16.02%: the best performer on the 200 today on some positive drilling results at the South Australian Western Gawler Project. The initial drill results have the project on course for a similar set up as Oz Minerals key development project at West Musgrave. The price of nickel has been under pressure over recent years but as we increasingly turn to the use of batteries, the demand profile over the medium term looks positive and prices should adjust accordingly.

Western Areas (WSA) Chart

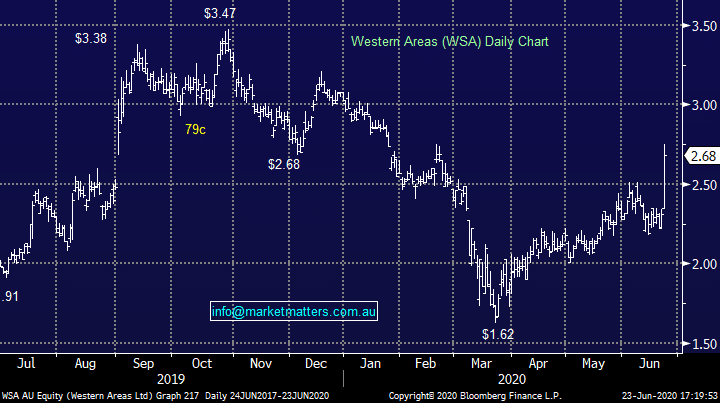

Recently we’ve seen the market “Big Boys” turn their attention towards nickel with OZ Minerals (OZL) buying Cassini Resources (CZI), while BHP Group (BHP) has bought Norilsk’s Honeymoon Well Nickel Project and Western Areas (WSA) bought a cornerstone stake in Panoramic Resources. When we simply glance at the price decline in nickel over the last year its easy to envisage why its catching some people’s attention, especially if they’ve just ridden the huge iron ore bull market.

Nickel Spot ($US/MT) Chart

Recently we’ve seen the market “Big Boys” turn their attention towards nickel with OZ Minerals (OZL) buying Cassini Resources (CZI), while BHP Group (BHP) has bought Norilsk’s Honeymoon Well Nickel Project and Western Areas (WSA) bought a cornerstone stake in Panoramic Resources. When we simply glance at the price decline in nickel over the last year its easy to envisage why its catching some people’s attention, especially if they’ve just ridden the huge iron ore bull market.

Nickel Spot ($US/MT) Chart

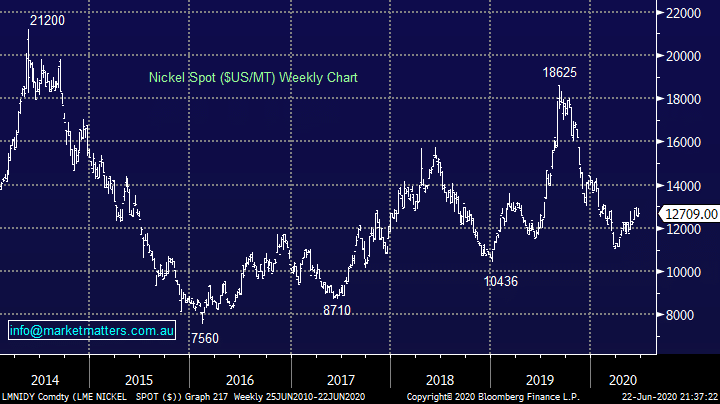

Panoramic Resources now has a market cap of under $150m and considering its decoupling from Western Areas (WSA) this year it’s interesting to see the $630m nickel producers interest – WSA recently took a 19.9% stake through a capital raise by PAN. We feel PAN is a good “cheeky punt” around current levels for the adventurous.

Western Areas (WSA) v Panoramic Resources (PAN) Chart

Panoramic Resources now has a market cap of under $150m and considering its decoupling from Western Areas (WSA) this year it’s interesting to see the $630m nickel producers interest – WSA recently took a 19.9% stake through a capital raise by PAN. We feel PAN is a good “cheeky punt” around current levels for the adventurous.

Western Areas (WSA) v Panoramic Resources (PAN) Chart

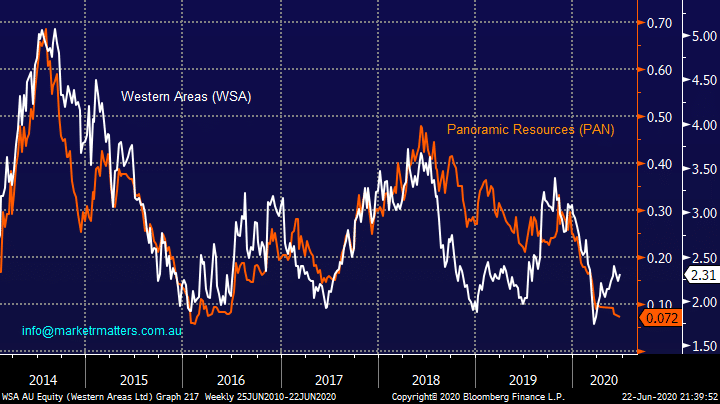

The other smaller Nickel company that we’ve been reviewing is Mincor (MCR) which is capped around $300m, a company with a checkered history although less so than Panoramic. MCR is a sort of ‘middle ground’ between the large cap WSA and the small cap / super high risk PAN. Andrew Forrest owns 14% of MCR while BHP also has reasons to see MCR’s Kambalda Project in WA get off the ground. Importantly, Mincor will produce a nickel sulphide concentrate, and so is exposed to the battery metal thematic.

Mincor (MCR) Chart

The other smaller Nickel company that we’ve been reviewing is Mincor (MCR) which is capped around $300m, a company with a checkered history although less so than Panoramic. MCR is a sort of ‘middle ground’ between the large cap WSA and the small cap / super high risk PAN. Andrew Forrest owns 14% of MCR while BHP also has reasons to see MCR’s Kambalda Project in WA get off the ground. Importantly, Mincor will produce a nickel sulphide concentrate, and so is exposed to the battery metal thematic.

Mincor (MCR) Chart