New intraday all-time high! (NST, CWN, SZL)

WHAT MATTERED TODAY

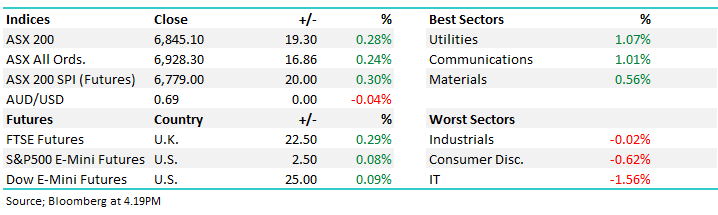

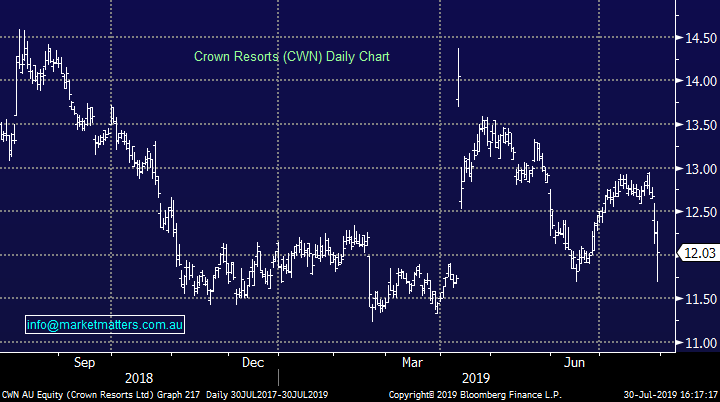

The ASX200 quickly rallied to a new intraday all-time high this morning despite a muted lead from the US markets overnight. Banks and resources rallied together to send the index to a top of 6875.5 however traders faded the rally and it was quickly dragged back towards the previous record, toying with that level for the rest of the session. It eventually closed below 6851 signalling that the old record could be a psychological sell level and it looks like it will take a big effort from some market heavyweights to lift it over the top. Utilities and communication sectors continued their recent run as investors chase the yield. Locally, the tech names followed last night’s underperformance by the Nasdaq to trade lower as well.

BNPL debutant Sezzle (SZL) – an American focused lender which has joined competitors AfterPay (APT), Zip co (Z1P) & Splitit (SPT) on the ASX – more than doubled its $1.22 IPO price when it opened at midday. Those lucky enough to get their hands on stock also faded this move with SZL finishing a long way from the highs set early in its shortened session to close at $2.20, up over 80% on day 1.

Building approvals were out at 11.30AM this morning and were a little softer than expected. The residential market continues to languish with approvals down more than 25% yoy, and fell month on month – well below the small gain that was expected. There is a lot of negativity built in around the construction market and as a result not a great deal of selling seen in the building leveraged plays – we own Adelaide Brighton (ABC) in the Growth Portfolio, long from around these levels. We see no change to our plan here, adding into dips and selling into strength. Tomorrow will see local inflation and credit data out at 11.30AM again with the market watching closely for further validation of the aggressive rate cutting priced in.

Overall, the ASX 200 added +19pts today or +0.28% to 6845. Dow Futures are trading up 25pts / 0.09%.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

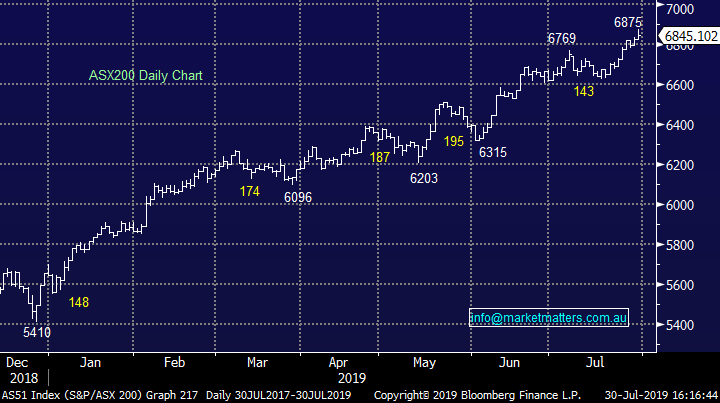

Crown (CWN) –1.88%; saw big intraday selling today, falling 3% from its highs. The casino owner was alleged to have had a deal with a number of government agencies in order to fast track visa processing for Chinese citizens looking to gamble at their high roller tables. The news broke over the weekend and the stock was lower yesterday. The stock tried to bounce today until nearly 1PM when the Attorney-General referred the allegations to the Australian Commission for Law Enforcement Integrity. Clearly not a great look for the company, and we put it in the ‘too hard basket’ for now as per the AM report.

Crown Resorts (CWN) Chart

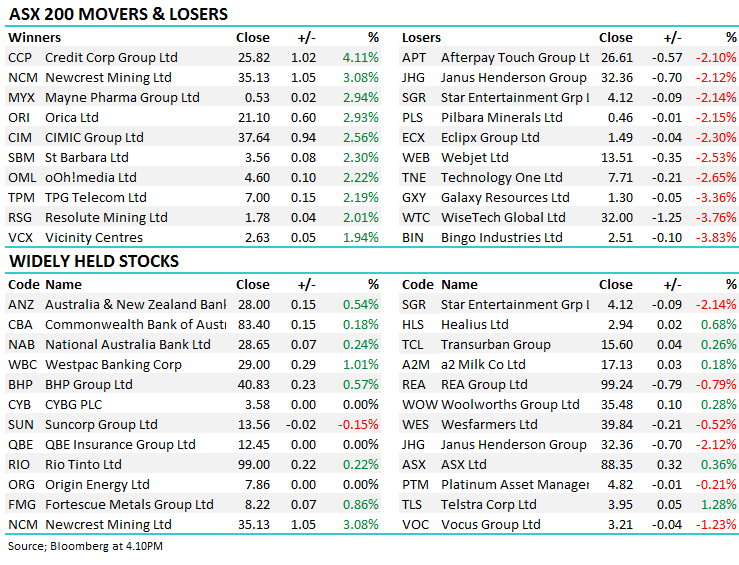

Norther Star (NST) +1.59%; the gold producer rallied today, backed up by a strong fourth quarter production report. The June quarter was a record for the company, with production coming in near the top end of guidance at 255koz taking sales for the year to a record 840koz. Driving the volume growth was some momentum in the turnaround of Alaskan asset Pogo which has eased some investor concerns over integration of last year’s acquisition. Production here rose 27% for the quarter, with the volume helping to reduce the average cost. Australian operations beat the top end of their guidance for the full year.

The only blight in the quarterly was a spike in costs which came in at $1296/oz, vs guidance of $1,225-$1,275/oz. Rising costs have been a common theme in quarterly reports for June with a number of other names across the commodity spectrum flagging costs inflation. NST is a great company with a number of world class gold assets with many years of life ahead. The company also has no debt and a bucket load of cash so it’s very likely we see money coming back to shareholders or a move on another asset. We like gold in AUD around these levels, with NCM being our preferred play.

Northern Star (NST) Chart

Broker moves;

- Cimic Upgraded to Neutral at Macquarie; PT A$40

- Credit Corp Upgraded to Buy at Canaccord; PT A$25.03

- Medibank Private Cut to Underweight at JPMorgan; PT A$3.33

- NIB Downgraded to Underweight at JPMorgan; PT A$6.58

- Oil Search Downgraded to Hold at Shaw and Partners; PT A$7.50

- Pilbara Minerals Cut to Speculative Buy at Blue Ocean; PT A$0.80

- Reliance Worldwide Downgraded to Hold at Baillieu Ltd; PT A$4

OUR CALLS

No changes to the portfolios today.

Major Movers Today – Newcrest (NCM), which we hold in the Growth Portfolio well outperformed gold peers with a solid exploration update. Bingo (BIN) was worst on ground, selling off intra-day with the building numbers as well as a broker talking down the growth prospects of the waste management business.

Have a great night

James, Harry the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 30/07/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not withstanding any error or omission including negligence.