Never let a good crisis go to waste (PMV, CSR, KGN)

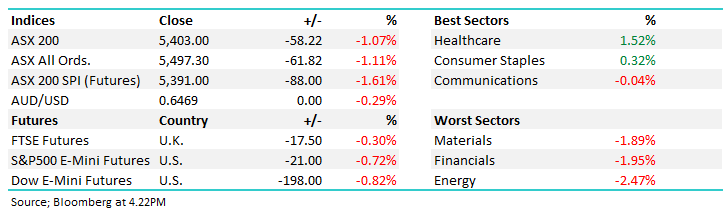

WHAT MATTERED TODAY

Risk on yesterday, risk off today as sellers remerged, particularly towards the sectors that have seen recent buying namely energy & real estate. Strong comments from Premier Investments (PMV) around rents one catalyst, more on that below however suffice to say there will be a lot of tenants trying to make the most of this current crisis, attempting to lock in more favourable (ongoing) terms, Lew the first of many I suspect.

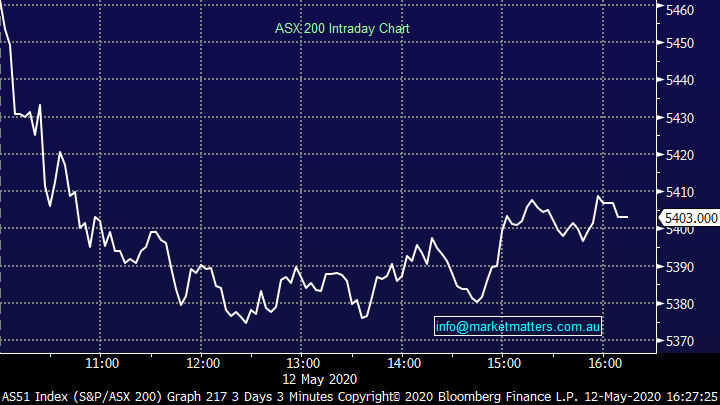

The market opened down marginally this morning however sellers built throughout the day before a low of -85pts just after lunch - some tentative buying into the close saw the index closes back up above 5400. US Futures chopped around for the day with a negative bias while Asian market were mostly lower, Japan the only mkt to keep its head above water (just)

News out this afternoon that Wuhan will test its entire population (11 million people) after 6 cases were found while in NSW, we had no new of COVID-19 cases today.

I’ve had my first day back in the office today in around 7 weeks and the city remains fairly sparse, traffic still low and cafés still pretty grim, although I’m told today was the busiest day yet.

Overall, the ASX 200 fell -58pts / -1.07% today to close at 5403 - Dow Futures are trading down -197pts/-0.79%.

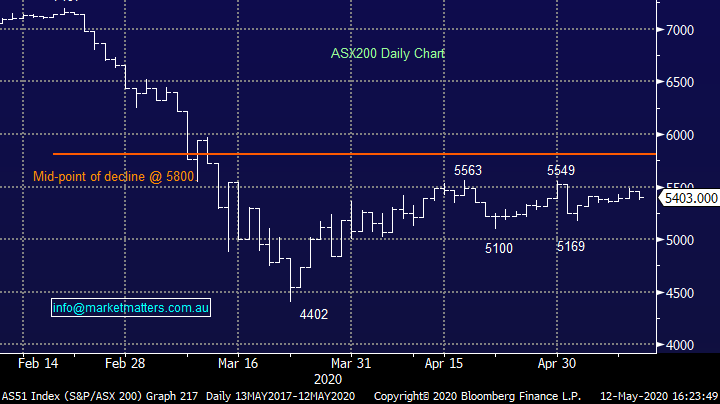

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE:

Soloman Lew & Premier Investments: The biggest retail tenant in Australia (brands including Smiggle, Peter Alexander, The Just Group, Jay Jays, Just Jeans and more) gave a pretty aggressive shot across the bow of retail landlords today, essentially saying Premier will pay what they think is fair and that number is something like 6% of gross in store sales.

PMV is in the enviable negotiating position of 1. Scale & 2. A large proportion of their lease book at or near expiry 3. They have a decent online presence. The approach was outlined today when they gave a trading update saying that global sales were down 74% in 6 weeks to May 6, although that included online sales, stripping that out sales were down 99% given the raft of store closures.

They say you should never let a good crisis go to waste and PMV are certainly having a very good crack at this with retail landlords in the cross hairs.

Premium Investments (PMV) Chart

CSR +10.06%: Out with full year results today that were better than the mkts downbeat expectations. They delivered underlying net profit for the full year of $125m versus consensus of $120m, however I saw a few brokers more bearish than that – Citi for instance was at $111m. Still, the $125m for the year was a ~30% decline on FY19 and expectations for FY21 are also fairly soft – expecting further declines of circa 13% although the company didn’t offer guidance. They also cut the final dividend + pulled the share buyback. CSR have no debt with ample liquidity, helped by another $200m funding facility announced today. This is a cyclical stock / sector, and while headwinds remain, CSR has the balance sheet to see it through. A good cyclical turnaround story for those with a 1-2 year view.

CSR Chart

Kogan.com (KGN) +5.88%: the online retailer shot to a near 2 year high today thanks to strong trade over the COVID_19 pandemic. Kogan added more than 7.5% to active customers in April, now with just shy of 2 million customers using the site. Sales were up 100%, and gross profit an even more impressive 150% for the month. Year to date adj. EBITDA is 40% ahead of last year as shoppers were forced online to satisfy the spending habits. While the growth is unsustainable, it is likely that a chunk of the new customers will continue to shop on Kogan.

Along with the business update, the company has proposed a long term share option incentive for founders Ruslan and CFO David Shafer. The two are the largest shareholders in KGN already – Ruslan holding 22% and David 8%. The offer relies on the executives hanging around until the FY23 report is handed down. The two sent the share price tumbling two years ago when they tried to offload a total of 10m shares, but they were only able to get 6m away. In any case, the stocks has done spectacularly well from the March lows and now trades on 41x, a big number.

Kogan.com (KGN) Chart

BROKER MOVES:

· Macquarie Group Cut to Hold at Morningstar

· Mineral Resources Cut to Hold at Morningstar

· Soul Pattinson Reinstated Hold at Morgans Financial Limited

· Suncorp Raised to Add at Morgans Financial Limited; PT A$10.44

· Scentre Group Cut to Underperform at Jefferies; PT A$1.93

· Appen Cut to Hold at Bell Potter; PT A$30

· Pendal Group Cut to Hold at Morgans Financial Limited

· Macquarie Group Cut to Hold at Shaw and Partners; PT A$110

OUR CALLS

No changes to portfolios today.

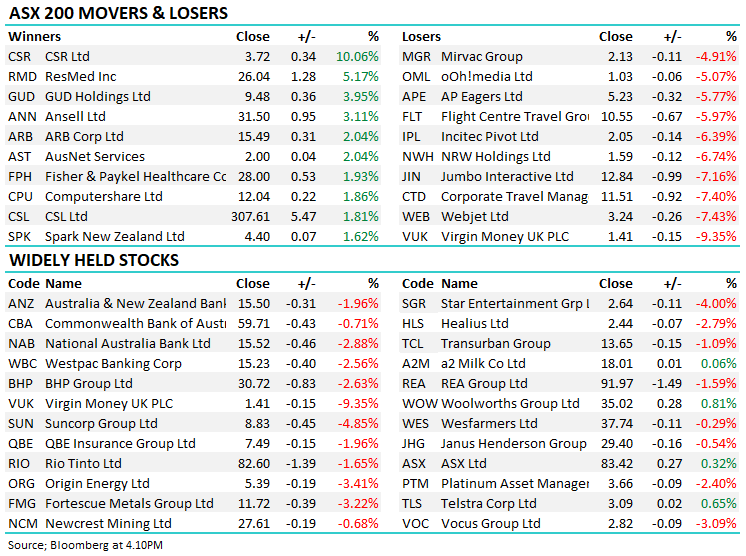

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.