Incitec Pivot (IPL) taps the market

Incitec Pivot (IPL) Trading Halt-: the fertilizer & mining explosives business raised capital alongside their half year report today. The report was better than expected with a ~7.5% beat to expectations on the EBIT line to $159m, up 34% on last year. The beat was driven by the decent growth in explosives in both Australia and the US while pressure from agriculture commodity prices weighed on that half of the business. The company is seeking to raise $600m through the institutional placement, and an additional $75m through an SPP for existing holders.

The raise has been called pre-emptive with IPL having substantial liquidity in the balance sheet in place but it does come after failing to find a buyer for their fertilizer business which had been under review. They trumpeted long term trends in both Ag and mining, though short-term hits to capex spend might choke earnings. The raise will take the net debt/EBITDA level to 1.9x, with $1.28b drawn of $3.45b available in facilities. At $2/share, the deal represents an 8.7% discount to Friday’s close, adding around 18.6% of shares on issue.

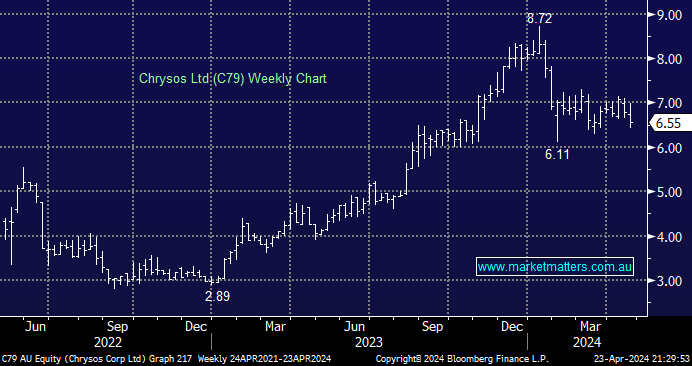

Incitec Pivot (IPL) Chart