NAFTA falls over, the markets roll over (NST, A2M, BAL)

WHAT MATTERED TODAY

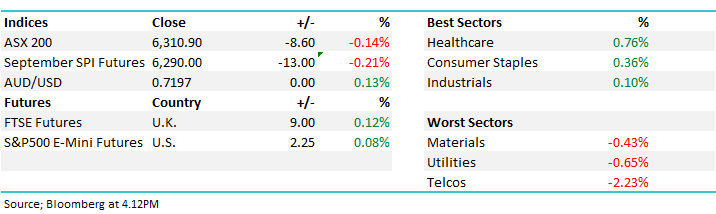

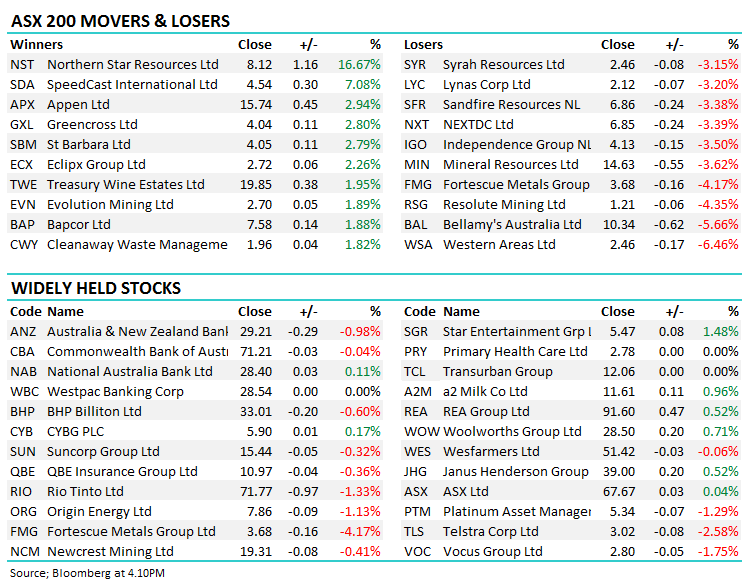

The local index never looked like living up to pre-market expectations as the trade war reared its head again. Just as it seemed Trump was getting along well with Mexico and Canada, the deals fell over and signs the US President is unwilling to negotiate returned. As a result, the resource names were hit, particularly nickel producer Western Areas which fell -6.46%, along with Asian markets which headed lower throughout the day. Telcos also saw recent weakness prevail as the pull back from recent telco mania continues.

Data also weighed on the markets sentiment today, with the double whammy of weak retail sales and house price figures dragging the consumer markets lower. The Aussie dollar also saw selling on the back of the numbers, hitting a 20-month low against the USD soon after the data came out, although it did bounce off this number to currently trade more or less flat on the day.

Overall, the index closed down -8 points or -0.14% today to 6310.

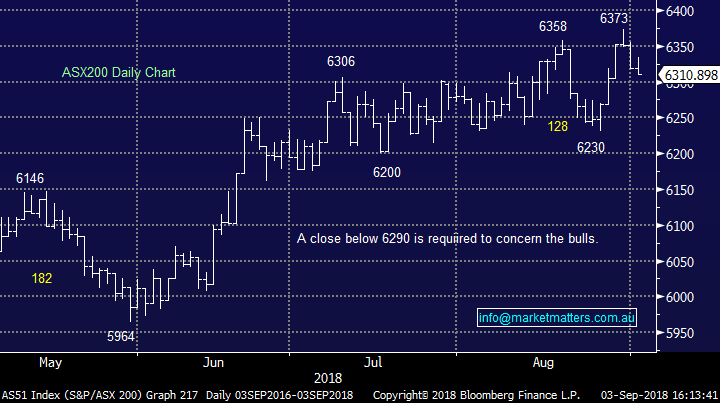

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Broker Moves; a quiet day for the brokers, still digesting reporting season.

· Freedom Insurance Group (FIG AU): Cut to Sell at Baillieu Holst Ltd

· Zenitas (ZNT AU): Zenitas Downgraded to Hold at Bell Potter; PT A$1.46

A2 Milk (A2M) $11.61 / +0.91% & Bellamy’s (BAL) $10.64 / -5.66%; The Chinese Government released new regulations for the e-commerce industry over the weekend, and although it is early in to implementation, it appears to have some impacts on participants in the Chinese retail market. A2 Milk released a brief note this morning, welcoming the new regulation which hopes to protect the Chinese consumer market which will force platforms into more responsibility over the products it sells and the protection of customers. This works to make to both harder and easier to sell into the ever growing Chinese middle class market. Those with Chinese retail licences should see an initial kick with inventory sell downs before the regulations come into effect next year, while seeing an ongoing demand while they are viewed as a responsible provider. Those without licences may also see the sales increase short term, however avenues to sell into the market will likely dry up as the regulations are enforced.

A2 Milk’s SAMR registration should help the company tackle to ever changing regulation in China, but while Bellamy’s application continues to be delayed the stock will likely struggle

A2 Milk (A2M) Chart

Bellamy’s (BAL) Chart

Northern Star (NST) $8.12 / +16.67%; gold miner spiked higher today after resuming trading following a capital raise announced on Thursday last week. The company was looking to raise $175m in order to partially fund the $US 260mil acquisition of Pogo, an underground gold mine in Alaska. New shares were issued at $6.70, a 3.7% discount to the previous close, which are now looking very cheap with the placement reportedly heavily oversubscribed.

The transaction has been compared to Northern Star’s previous acquisition of Jundee – a key asset in operation, with cost out ability and potential to extend mine life with further discoveries. The acquisition gives Northern Star three high quality assets with the potential for each to produce over 300,000oz of gold per annum, just 17 mines are currently producing more than this in the Tier-1 mining jurisdictions of Australia, the US & Canada. Just a fortnight ago many were discussing why NST hadn’t paid a special dividend or launched a buyback with the mid-tier gold miner debt free and cashed up to the tune of ~$430mil. The acquisition is a big one, but hasn’t come at a huge cost with new shares making up just 4% of shares on issue. The risks to the purchase lay with the companies move offshore, no longer just the Australian miner.

Northern Star (NST) Chart

OUR CALLS

No trades across the MM Portfolio’s today.

Have a great night

Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 03/09/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.