NAB report OK – the rest of market copped a battering

Mattered Today

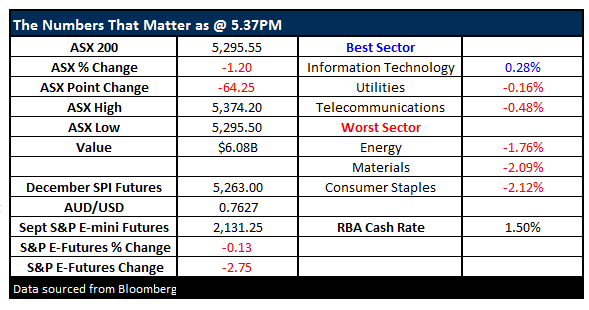

Another session of weakness for stocks and once again, the majority of the selling was focussed on the Aussie market. A few key points from the outset to help explain our thoughts on the current flow of the market.

5350 was our tipping point to go from bullish to neutral / bearish. We traded through that level today and closed below it so our stance becomes more defensive. For that reason, we took profits on ANZ today which accounted for 10% of our portfolio and allocated 5% into a more defensive holding. This boosted our cash levels, reduced our exposure to the banks as we’d been writing about over the past few weeks, and gives us some more ammunition to buy any further weakness that may prevail. Having flexibility in a market like this is key, and the moves we took today increases our flexibility. We have another stock on the radar that we may sell tomorrow to further increase cash.

ANZ Bank (ANZ) Daily Chart

In terms of the market performance, the ASX seems to have been targeted specifically from futures-led selling. This a theme we’ve written about on a few occasions, however, it’s relevant, and worthwhile explaining today. Big funds, professional investors, money managers etc – trade futures contracts to hedge risk, or take a directional view on a particular market. The selling today, and yesterday for that matter seemed to be futures led. If someone big is taking a negative stance on Australia, they can sell the SPI, which is a future contract over the top 200 stocks on the market. If that happens, a hedge needs to be put in place by those on the other side of the trade. A hedge would include selling the underlying stocks to offset the risk, and therefore we get a situation where the futures market can put a lot of pressure on the stock market. From then on, momentum builds and the selling becomes self-perpetuating.

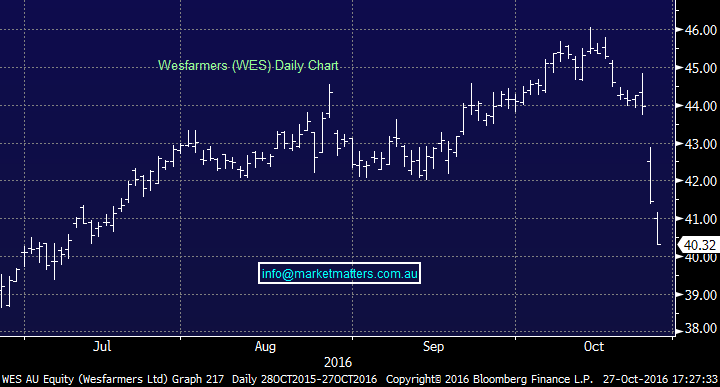

The range today was another big one printing +/- 79 points, a high of 5374, a low of 5295 and a close of 5295, off -64pts or -1.20%. Another big volume day as well with more than $6.5bn going through the bourse… We tried to bounce on a few occasions – but got clobbered every time we did eventually closing on the lows.

ASX 200 Intra-Day Chart

ASX 200 daily

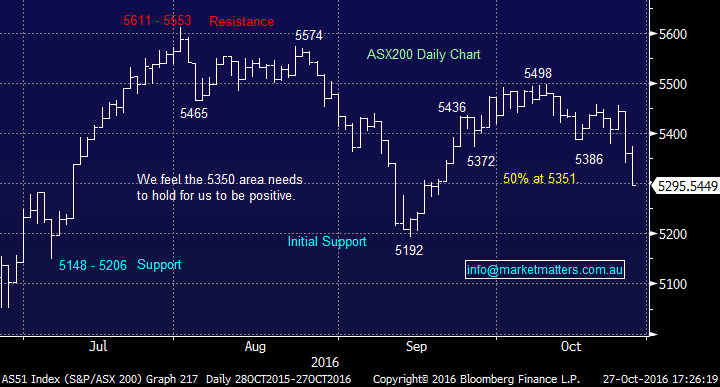

Nab reported this morning and the report was OK. You could argue quality was low given lower bad debts and margins were weak, however, capital position was very good which has been one of the key elements focussed on by the market. The dividend stayed firm at 99c which was pleasing, however, the payout ratio at 88% is clearly unsustainable – and will need addressing at some point soon. We’ve got a presentation with the CFO next week so we’ll write more about it then.

Worth also noting though that when ANZ reported a few months ago, a better capital number spurred some very strong buying in the stock. Given the market is still factoring in future capital raisings, and today's report probably casts more doubt on that, the banks should be reasonably well supported – in a relative sense that is. We still think it makes sense to trim holdings into a weak period (November the weakest month for the banks all year) and re-visit the sector closer to Christmas.

NAB (NAB) Daily Chart

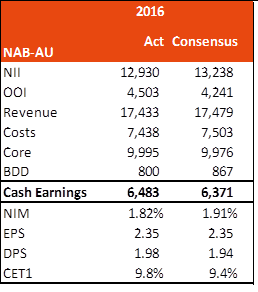

Elsewhere, we had Wesfarmers continue to sell off following weak sales numbers yesterday – and it’s just another example of the market taking the boot to anything that has the slightest stench to it…

Wesfarmers (WES) Daily Chart

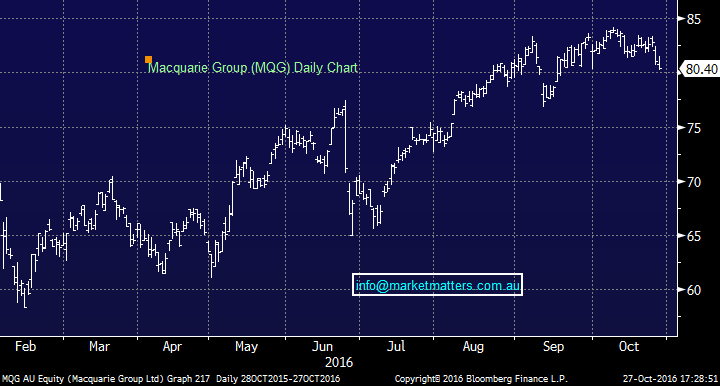

…And finally, Macquarie Reports tomorrow – here’s the view of Shaw & Partners

On 19th September MQG said expect 1H17 to be around 2H16 or $993m. We have weaker revenue growth than the market but lower costs.

- Key Focus: We are expecting solid 1H17 result with no surprises, NPAT of $993m, EPS $2.89 and a first-half dividend of $1.60.

- 2017 Guidance: MQG is guiding to flat profits in FY17. We take this to mean around $993m in 1H17, in line with 2H16.

- Flat Profits: MQG are saying performance fees of FY16 will be difficult to repeat (FY16 $717m we assume $333 in FY17); securities will be down, but rest of business is growing. Offset to lower performance fees will be lower impairments; Commodities and Financial markets business stable.

- Annuity Style Businesses continuing to perform well (~70%) – Asset Management business benefiting from higher base fees, CAF (Esanda and AWAS) integrations going well.

- Market Facing Businesses mixed (~30%) – FICC business benefiting from better trading conditions but expect Macquarie Capital to be more subdued.

Macquarie (MQG) Daily Chart

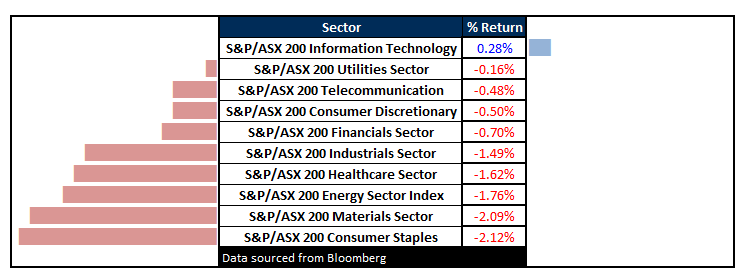

Sectors

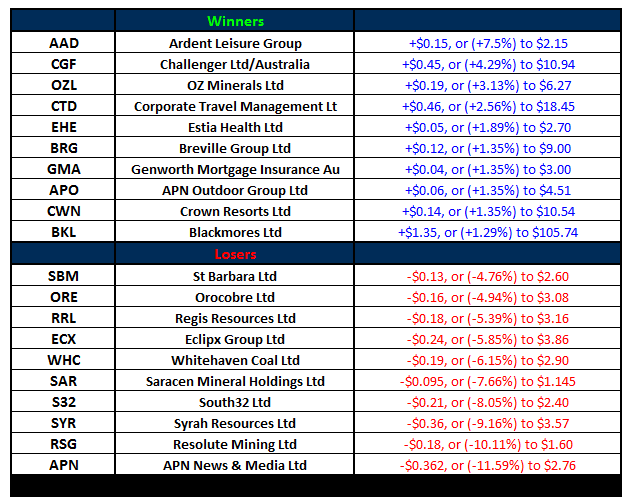

ASX 200 Movers

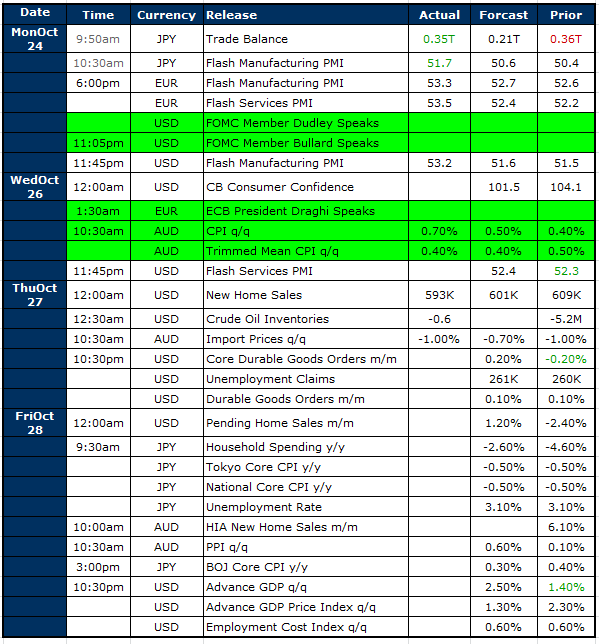

Select Economic Data - Stuff that really Matters in Green

What Matters Overseas

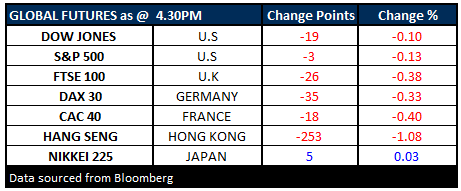

FUTURES lower….

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 27/10/2016. 4.30PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here