More upside than downside in Telstra, say JP Morgan (TLS, PRY)

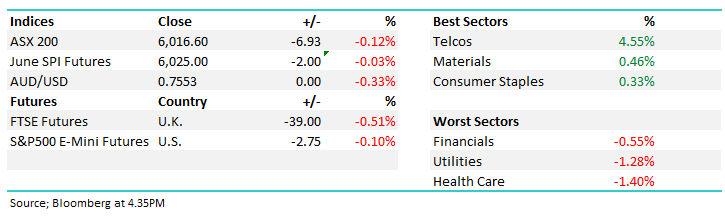

WHAT MATTERED TODAY

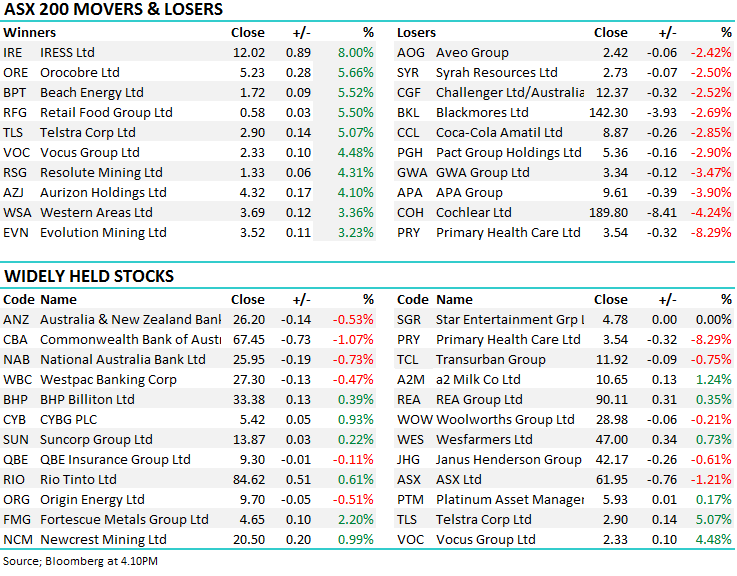

Some of the dogs started to bark today with a bullish broker upgrade for Telstra (TLS) underpinning a big day in that stock – adding +5% - - while the Lithium names including our own Orocobre (ORE) were also in the black - ORE the standout bouncing by +5.66%. Overall, the market was again weak in aggregate, weighed mostly by the banks with selling most aggressive in the morning Obviously the strength in Telstra underpinned the Telco’s while the Materials also did ok – on the flipside, Cochlear (COH) was hit hard, no news but some decent selling which implies someone with some volume keen to get off the train!

Overall the ASX 200 index lost -0.11%, or -7 points to 6016 while the DOW Futures are trading down -34pts at time of writing.

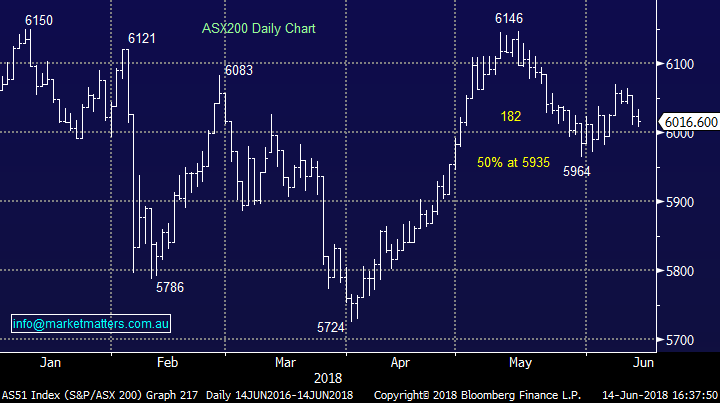

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Broker Moves; A busy day for brokers today and it seems we sold our Webjet (WEB) position a day early – the stock rallying on the back of a Morgan Stanley upgrade with the broker keen on Hotel Trading Tailwinds apparently! The stock rallied as a result however in fairness, they’ve called the stocks pretty poorly…upgrading post the ~40% rally…

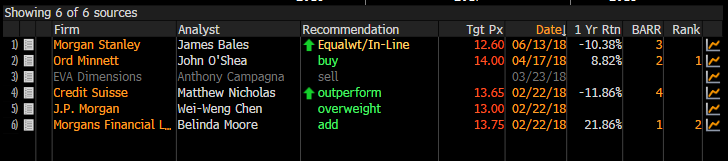

Here’s the current broker calls….

· Gateway Lifestyle Cut to Hold at Shaw and Partners; PT A$2.10

· Primary Health Downgraded to Sell at UBS; PT A$3.50

· Aurizon Upgraded to Buy at UBS; PT A$4.60

· NRW Holdings Rated New Buy at UBS; PT A$1.90

· Imdex Rated New Buy at UBS; PT A$1.70

· Ausdrill Rated New Buy at UBS; PT A$2.65

· Ausdrill Upgraded to Buy at Hartleys Ltd; PT A$2.72

· Monadelphous Rated New Buy at UBS; PT A$15.70

· Sino Gas Downgraded to Neutral at Macquarie; PT A$0.25

· APA Group Upgraded to Outperform at Credit Suisse; PT A$11

· Telstra Upgraded to Overweight at JPMorgan; Price Target A$3.30

· Adairs Upgraded to Add at Morgans Financial; PT A$2.50

· Webjet Upgraded to Equal-weight at Morgan Stanley

Telstra (TLS) $2.90 / 5.07%; we’ll cover more tomorrow however JP Morgan staying that they believe the potential upside from current levels outweighs downside – and they reckon a 25-30% dividend cut is priced in + a 25% decline in postpaid ARPU. They go on to say that investors are getting a free option on any strategy initiatives at this price, some of those might be a redirection of focus around the NBN (we think) – an announcement / more colour could be provided on the 20th June at their strategy day. Better news (clearly) from TLS today and we remain keen on the ugly duckling!

Telstra (TLS) Chart

Primary Healthcare $3.54 / -8.29%; A change of analyst at UBS has caused a significant fall in Primary Health Care’s stock this morning, with the new lead having a materially different view from the old, dropping the rating to a sell, and the target 12.5% to $3.50. UBS noted that the stock was trading on PE of ~20x earnings, now lower after today’s move, with little growth trajectory and risk to profits – bulk billing changes, Fair Work Commission review into wages among other risks. The stock has dropped 9% today and is now trading around the revised target price.

We like PRY, although today’s move may lead to a breakdown technically. We flagged PRY as a potential takeover target back in May and today’s weakness could entice China’s Jhango Group into making a move.

Primary Health Care (PRY) Chart

OUR CALLS

We closed out of Fortescue (FMG) today after the stock breached our stop on close yesterday.

Have a great night

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 14/06/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here