Mixed fortunes as ASX rallies of lows

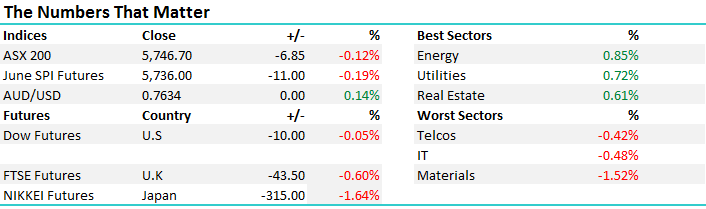

A tail of two sectors today with the banks roaring back from early weakness while the Resources suffered from continued selling in Chinese Iron Ore and Steel Futures which have traded at their lowest level in more than 6 weeks. Energy was strong on the back of higher Crude prices overnight. A range today of +/- 41 points, a high of 5749, a low of 5698 and a close of 5747.

ASX 200 Intra Day Chart

ASX 200 Daily Chart

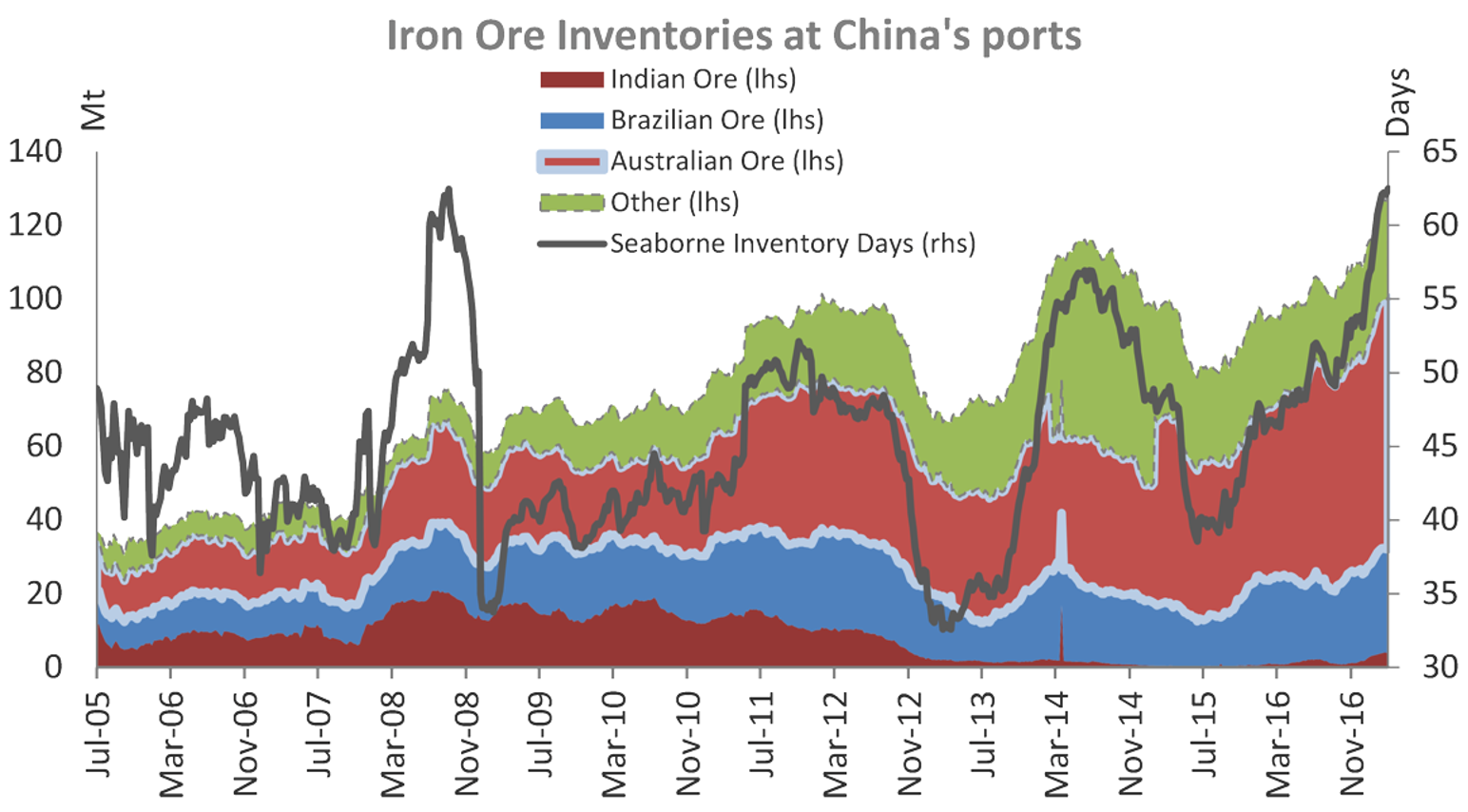

A good chart from Chris Weston over at IG in a note today highlighting the rising inventories of Iron Ore – which as can be seen from the dark grey line is at or above decade highs . Typically re-stoking takes place ahead of Chinese new year however we’ve haven’t really see a drop off post that period which would usually be expected. One theory that has been doing the rounds and we discussed this with Nev Power from FMG last week, is around the desire of Chinese policy makers to maintain a strong Steel price going into the Peoples Congress in October. High Steel prices mean mills are less price sensitive to inputs such as Iron Ore, therefore the price remains supported. The issue with this theory is the high proportion of speculative trading that now goes on, which means the price can’t be as easily manipulated / supported!!

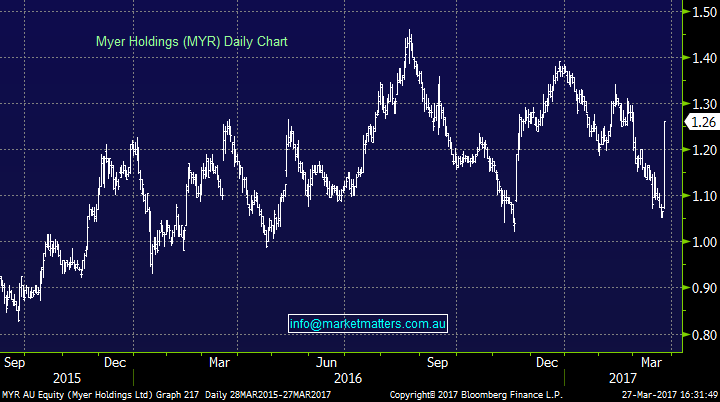

There was a big trade crossing in Myer today with around 10% of the company changing hands at a slight premium to the market when it was done at $1.15. No single holder has such a large stake so it’s a collective sell down with the buyer tipped to be Solomon Lew. 81.7 million shares crossed which is a big slice however if it is Lew, you’d bet your bottom dollar there’s a larger plan at play and this will just be the start. We’ll know soon enough. Shares in MYR closed up 19.5% to $1.26.

Myer (MYR) Daily Chart

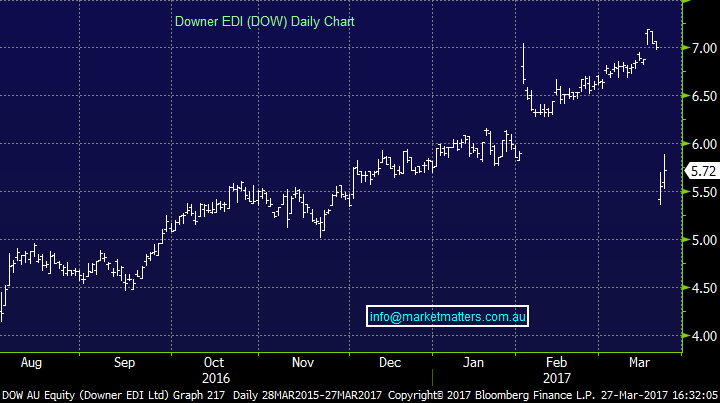

Elsewhere, UBS were busy in the market again offloading shares in DOW, for a 40c loss after underwriting the recent cap raising to acquire Spotless. A smaller ($9.4m) loss on this transaction which is clearly a better result than their previous underwriting efforts for Arrium (ARI) a short while before they called in the administrators.

Downer (DOW) Daily Chart

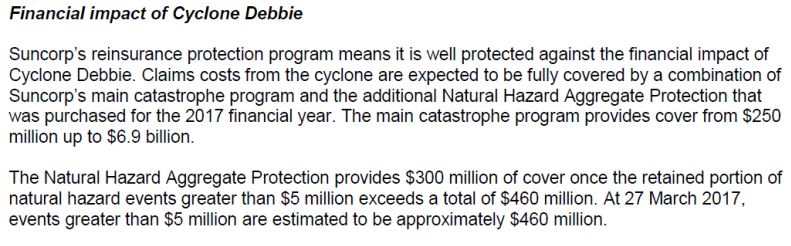

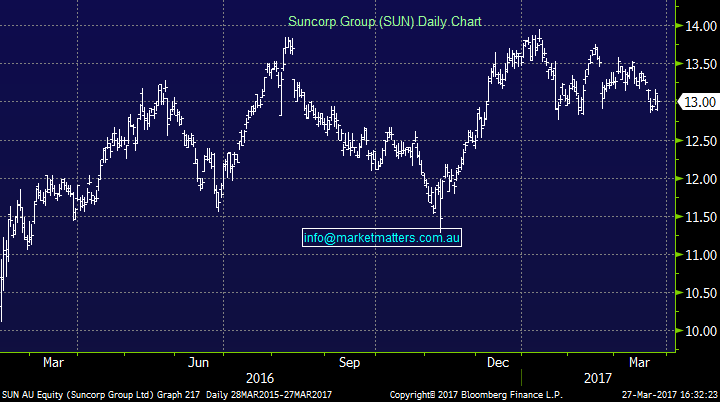

....and Suncorp is reporting no impact from Cyclone Debbie with reinsurance covering costs, which is obviously as relief however it also speaks to SUNs strategy about reducing (as much as economical) exposure to big one off hits....We continue to like Suncorp (SUN) and it remains a core holding in the MM portfolio

Suncorp (SUN) Daily Chart

Have a great night,

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 27/03/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here