Metcash delivers good set of numbers…

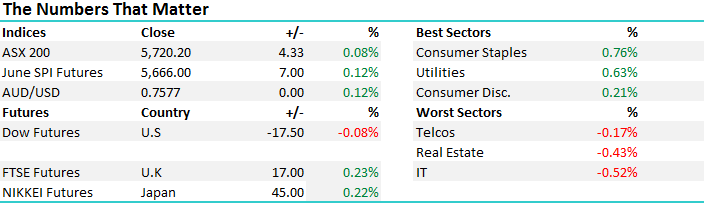

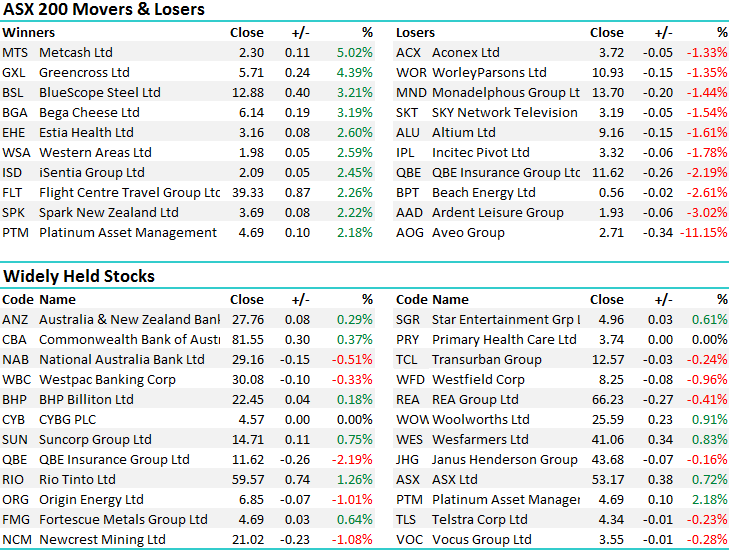

A good open to the market this morning however we failed to go on with it as sellers stepped up pressure from around 11am onwards and we drifted lower into the close. We made a change to the portfolio today, by selling Telstra and buying Wesfarmers, suggesting a buy write strategy for those that dabble in options – a reasonable return if exercised post dividend of around ~6% for a 94 day hold.

On the broader market today, it was the consumer staples that stood out following a better result from Metcash (MTS) and re-instatement of the dividend which put a bid under the sector. On the flip side, Real Estate stocks gave back some of their recent strength while IT stocks were soft dropping by 0.52% - an overall range of +/- 38 points, a high of 5749, a low of 5711 and a close of 5720, up +4pts or +0.08%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

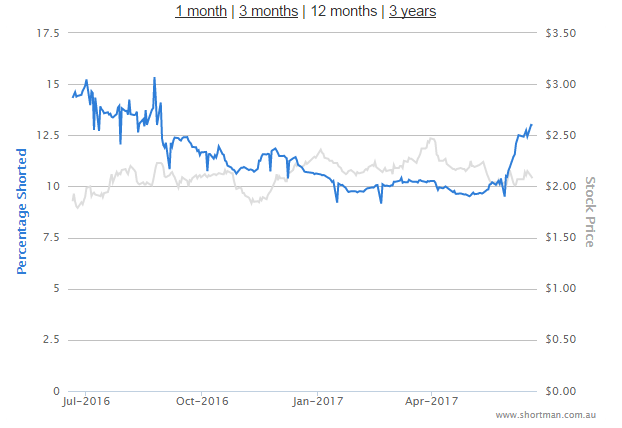

Metcash (MTS) – Announced full year earnings today and the result was better than the market had feared and importantly shorts have been building ahead of this result, therefore a good pop higher played out today, probably more on short covered than anything else.

Metcash – short positions more than 12.50% of issued capital

In terms of earnings, there was clear slowdown in sales momentum in the grocery division, but that was expected and they delivered a better result in terms of costs which helped the bottom line. We don’t own MTS however it’s interesting in terms of the retail landscape and how they see Amazon impacting the status quo. To that end they down played the likely impact saying "I think they will bring to Australia their tried and tested marketplace model, rather than food. I expect that will be their immediate focus."

Metcash (MTS) Daily Chart

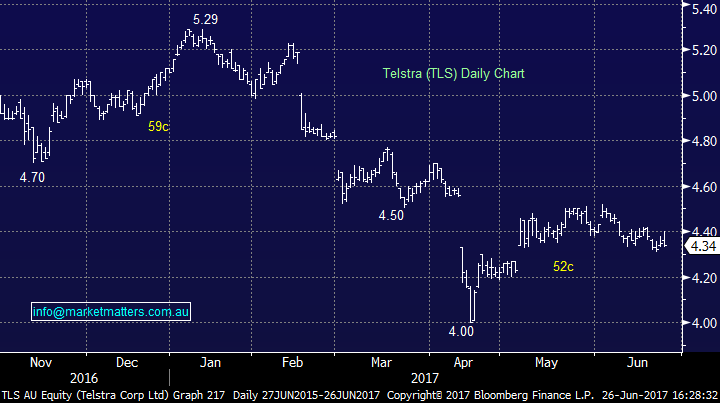

We took a very small profit in Telstra (TLS) today after buying at $4.29 and switched into Wesfarmers (WES) despite being overall negative retail in the medium term. Although Wesfarmers is clearly involved in the retail space, the selloff we’ve seen in the last few months has been aggressive, with the stock down from an April high of $45.50 to now trade at $41.00. The one thing the market hates is uncertainty and the looming arrival of Amazon has clearly fuelled this concern. The impact and timing of Amazon at this stage is difficult to quantify so the market has gravitated towards the worst case scenario and sold the sector fairly hard – including Wesfarmers. This now presents an income opportunity leading into the fully franked dividend in August. For sophisticated investors, we can also include an option positon by selling the $41.51 September Call option for around 70c. If exercised at expiry, the positon will return approximately 6% (incl dividends & franking) for a 94 day hold period.

Wesfarmers (WES) Monthly Chart

In terms of Telstra, we simply can’t see the stock bouncing from current levels in the near term as we approach a seasonally strong period for the market in July. With uncertainty in the telco space lingering, and continued concerns around the sustainability of the Telstra dividend, we think it’s wise to sell out for a small profit and move on.

Telstra (TLS) Daily Chart

Have a great night

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 26/06/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here