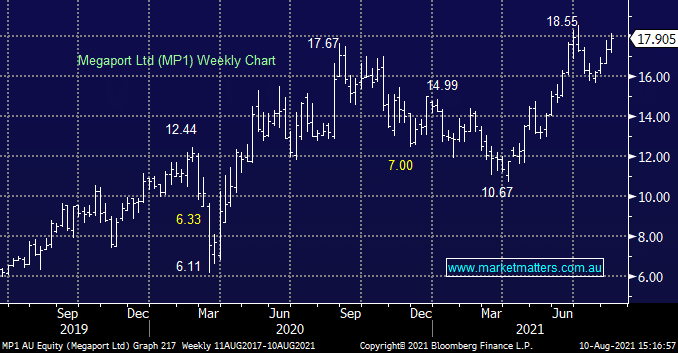

Megaport (MP1) shares rally on FY21, where to next?

MP1 +3.11%: The Network as a Service (NaaS) provider had pre-reported top-line metrics however the details of the result was positive. Revenue of $78m was largely inline with consensus expectations while an after tax loss of $31.3m was a touch better than expected. The pro’s to the result included MP1 achieving EBITDA breakeven in June 21 as they had been targeting, strong growth in ports added + reoccurring revenue which all bode well for FY22. No guidance was provided. All in all, we like MP1 even though we recently sold out of the stock, more a portfolio decision that a reflection on the business.