May kicks off with strength…

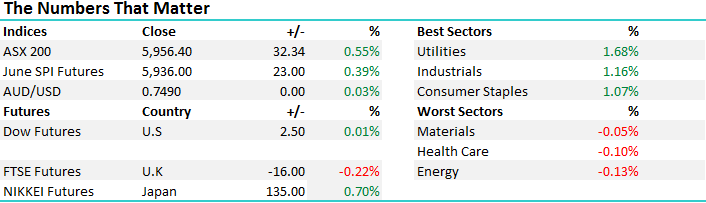

A good day for the market overall to kick off the new month with the market grinding higher throughout the session, although interestingly it was the defensive names that did the heavy lifting with Utilities, Industrials and Consumer Staples copping most attention. The Banks were also good with ANZ closing up 0.58% to $32.95 ahead of its 1H result tomorrow morning, more on that below while Westpac was also strong adding 0.68% before they report next Monday. CBA continued to lag the sector adding 0.07% to close at $87.46.

The market chopped around for the first part of the session before finding it’s groove from lunchtime onwards. We had a range today of +/- 39 points, a high of 5956, a low of 5916 and a close of 5956, up 32+pts or +0.55%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

At this juncture, the ‘Sell in May’ mantra is getting a decent workout and there is statistical significance for it as the chart below shows. Overall we’ve had a very good start to the year and an even better rally following the election of Mr Trump a little over 100 days ago. Clearly some caution and an increase in cash levels seems warranted at this juncture.

ASX200 Annual Seasonal Chart

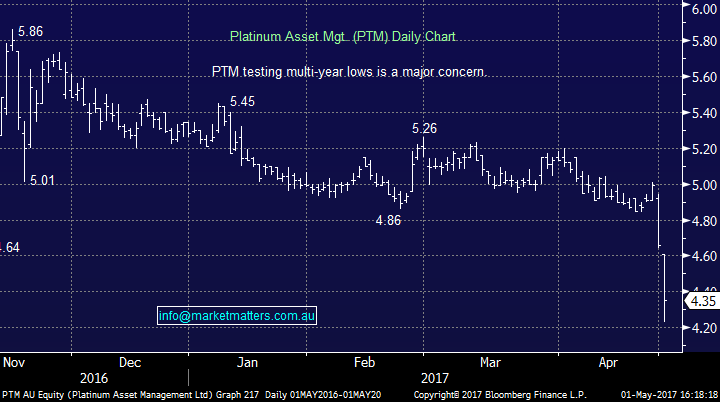

We sold our position in PTM today for a loss after last week they announced plans to reduce management fees on more than 70% of its funds under management and to implement a performance fee structure. This is in direct response to increasing pressure from passive funds, (ETFs etc) that are lower cost but track rather than outperform a benchmark. Higher cost funds clearly rely on performance to attract money – it’s their value add. When shorter term performance lags, they typically see outflows. This has been obvious with Platinum in recent times. The recent change in fee structure and lack of any buy back almost 8 months after it was announced creates too much uncertainty. Technically, $4.00 is the next obvious target, although we do concede that the previously announced buy back could start at any time and this would support the share price.

Taking a step back, clearly a new strategy creates risk and the market today (and Friday) voted with its feet. Next week they will release FUM figures for April which will be key to the stocks near term performance, however in the interim, we’re more comfortable to stay on the sidelines on this one.

Platinum Asset Management (PTM) Daily Chart

Banks will be the main focus this week with two of the majors reporting 1H numbers. The sector has been a huge driver of the ASX200's recent strength gaining an impressive 23% since the US election, including ignoring an almost 12% correction by the US banks. However we have to question whether this outperformance can be maintained in May / June, particularly after the majority trade ex-dividend. We continue to hold positions in ANZ and NAB, however sold CBA on Friday.

Upcoming bank report expectations;

May 2nd (Tomorrow)

- 1H cash profit est. A$3.49b (5 analysts, range A$3.24b- A$3.58b)

- 1H cash EPS A$1.15 (4 analysts, range A$1.06-A$1.23)

- Interim div. est. A$0.80 (5 analysts); BDVD est. A$0.80

- We hold ANZ in the Market Matters Portfolio

May 4th (Thursday)

- 1H cash profit est. A$3.23b (4 analysts, range A$3.19b- A$3.25b)

- 1H cash EPS A$1.19 (6 analysts, range A$1.15-A$1.22)

- Interim div. est. A$0.99 (4 analysts); BDVD est. A$0.99

- We hold NAB in the Market Matters Portfolio

May 5th (Friday)

- FY GAAP est. A$2.13b (9 analysts, range A$2.01b-A$2.21b)

- Final div. BDVD est. A$2.55

- FY EPS A$6.16 (13 analysts, range A$5.79-A$6.57)

May 8th (Next Monday)

- 1H cash profit est. A$4.02b (4 analysts, range A$3.93b- A$4.07b)

- 1H cash EPS A$1.18 (5 analysts, range A$1.16-A$1.21)

- Interim div. A$0.94 (3 analysts); BDVD est. A$0.95

Have a great night,

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 01/05/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here