Materials carry the index (NCK, RMD)

WHAT MATTERED TODAY

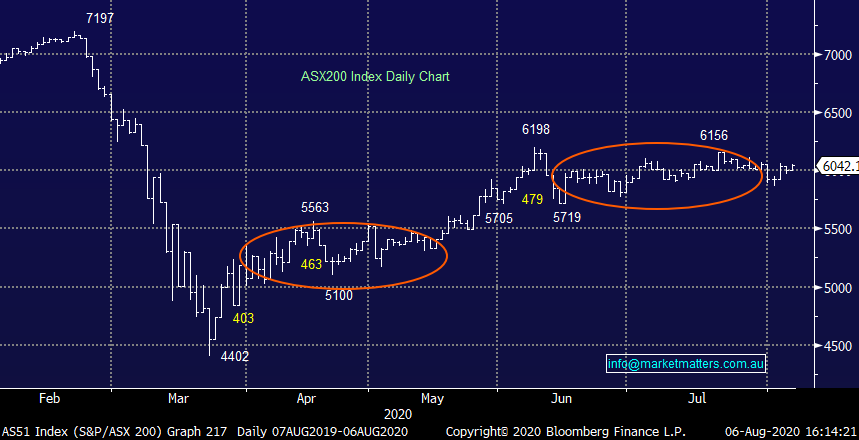

The local market tracked the risk on trade seen overnight that took the S&P to within 2% of all time highs. For the bulls, it was positive to see a rally away from the key 6000 level that was breached briefly yesterday with resources in particular leading equities. It was even more positive to see local shares track higher despite weakness in the region – broadly speaking Asian indices were lower today. Materials and energy were boosted by strong moves in commodities overnight. Oil prices has started to regain some momentum as inventories begin to show draw downs as demand creeps back in.

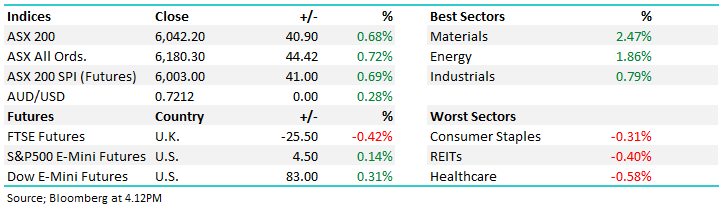

Overall, the ASX 200 added +40pts / +0.68% to close at 6042. Dow Futures are trading up +83pts / +0.31%

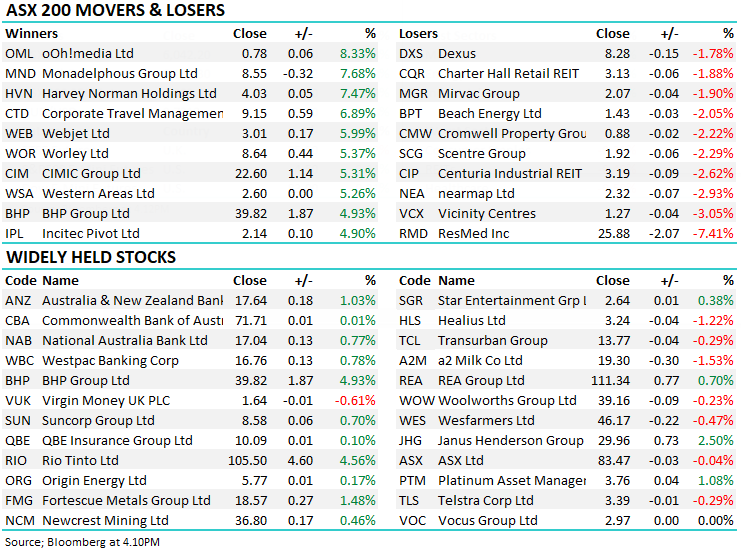

A couple of the more watched names reported today – we touch on Nick Scali (NCK) and ResMed (RMD) below. Scentre Group (SCG), owner of a number of Westfield malls, pre-released results due later this month, expected a 10% downgrade to asset values and operating cashflow of more than $250m. The stock was off -2.29% on the back of the news. Centuria Industrial REIT (CIP) was back trading and managed to hold the $3.15 price they raised money at yesterday after their result.

LOCAL REPORTING CALENDAR: CLICK HERE **Please note, data sourced from Bloomberg, not all ASX companies are on this list and dates can vary**

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE

Nick Scali (NCK) +14.58%: furniture retailer was out with their full year report pre market – James touched on the result in this morning’s Frist Reactions. It was a beat, no doubt about it. They pre-released earnings back in June, just a few weeks out from the end of the Financial year but even that sold the result short. Profit of $42.1m was 5% above the top end of guidance and flat on last year. The market had grave concerns around the discretionary spend, particularly with Nick Scali’s leverage to a healthy housing market – which has been anything but healthy during lockdowns. It looks as though while people couldn’t travel, they used the additional funds to spend on themselves and their home, driving decent demand for Nick Scali’s mid to upper market furniture. The current financial year was also off to a flying start with the company noting that strong momentum in the 2nd half, which saw ~20% growth on the first, had continued into the first half with the company expecting 50-60% growth on the first half of last year despite the temporary closure of a number of Melbourne sites. Shares hit all time highs today. While we aren’t prepared to chase NCK just yet, it does give a positive read through for other retailers heading into reporting - we own Super Retail Group (SUL) in the income portfolio.

Nick Scali (NCK) Chart

ResMed (RMD) -7.41%: took a hit today on their 4th quarter revenue update which saw US sales take a steep dive in the face of falling sleep apnoea detections as hospitals focus their effort on the corona virus battle. The company had started making and selling ventilators to help patients with the disease, but it was their main focus on the apnoea machines that saw sales dive which the market was concerned with. Around 80-90% of sales for RMD come from new diagnosis of the sleeping issue which relies on patients staying overnight at a practice or hospital – something which has clearly been disrupted of late. They have done well to refocus the business on more broader applications of ventilators but not one for us here.

ResMed (RMD) Chart

BROKER MOVES:

· Pinnacle Investment Cut to Market-Weight at Wilsons; PT A$5.70

· Qantas Reinstated Neutral at JPMorgan; PT A$3.50

· Fortescue Cut to Sell at Bell Potter; PT A$12.50

· Galaxy Resources Cut to Hold at Bell Potter; PT A$1.20

OUR CALLS

No changes today

Major Movers Today

Have a great night

Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.