Markets up but unconvincingly so…(WEB, PPT, A2M)

WHAT MATTERED TODAY

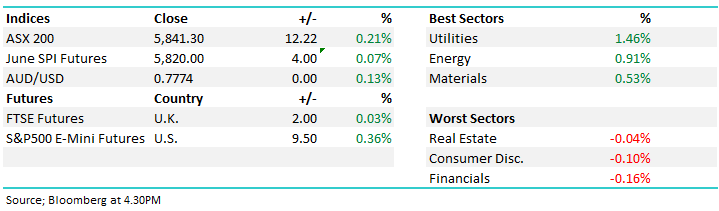

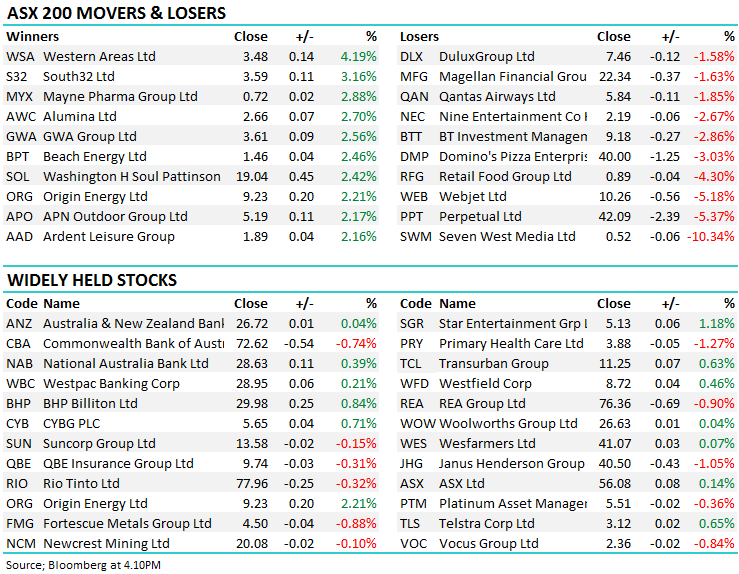

A strong open to trade this morning with the index taking is cues from US Futures which came online up around 0.5%/ +130pts for the Dow Jones despite the concerns surrounding the Syrian operation over the weekend, however our market peaked around 11am and simply slid for the remainder of the day, closing near the lows – US Futures drifted / still up +112 at our close so nothing too sinister. Some big portfolio trades went through today with the top 10 listed below – looked like portfolio trades and that seemed to sap some natural buying from the market.

CBA hit particularly hard today late in the session after underperforming during the morning to close off -0.74% to $72.62 while the other majors closed up but a way below the highs - the banks still struggling in the face of the Royal Commission which now turns its focus towards financial planning with some scathing headlines coming across the ticker in relation to fees, misconduct etc. As someone that has worked in the finance industry for a long time and seen a lot, the vast majority being good people assisting other good people, it’s obviously disappointing to see the cases being discussed – a pathetic effort and clear to see why investors are moving towards unbiased advice that adds value rather than product sales…

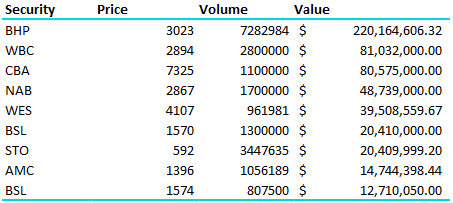

On the broader market today, the index eked out a small gain however by the close it was -27pts from early morning high. The ASX closing at 5841 up +12pts or +0.21%.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Broker Moves; It’s like all the pent up thinking and strategic portfolio shuffling seems to dribble out on Mondays and today was no different with some bigger macro notes + portfolio specific calls out from the bulge brackets…Morgan Stanley saying that we should cut resources but stay long energy while Macquarie singled out Origin as it’s Outperform call based on the assumption that the revenue coming from APLG should underpin the resumption in the dividend – while Morgan Stanley was keen on Woodside saying that growth projects will ultimately feed through to higher dividends over time. The crux here though is the oil price and is seems that the street is becoming more bullish here following the run up in prices. At MM, we’ve been targeting $US70 in Crude when it was significantly lower and we’re happy to sell into recent strength…

Today we saw;

* BHP Upgraded to Buy at Goldman; PT A$35.50 – Stock close up 0.84% to $29.98

* Silver Lake Upgraded to Outperform at RBC; PT A$0.80 – stock closed 1.03% lower at $0.48

* Ramelius Rated New Outperform at RBC; PT A$0.80 – stock closed 4.67% at $0.56

* Origin Energy Upgraded to Outperform at Macquarie; PT A$9.89 – stock closed 2.21 at $9.23

* Fletcher Building Downgraded to Hold at Morningstar – stock closed 0.33% lower at $6.00

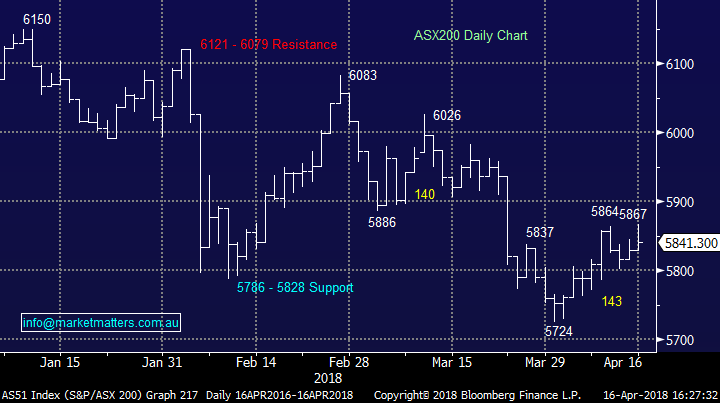

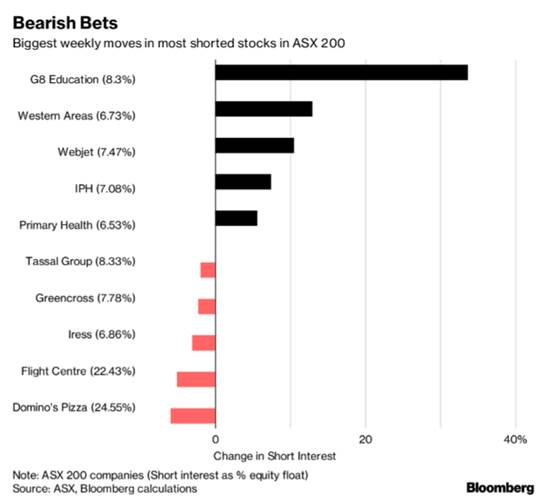

Webjet (WEB) $10.26/-5.18%; Hit hard today after a strong session Friday with the only announcement being a change in the CFO’s seat – not a big deal really, however the cynic can view the resignation of a CFO without much prior warning as a red flag – and it seemed that was the case today. The stock has now dropped through $10.50 support and it looks poor technically.

WEB was also a big mover in terms of weekly shorts – but then again, so was Western Areas (WSA) which topped the leader board today adding +4.19%. We hold WEB in the Growth Portfolio and remain in profit.

Webjet (WEB) Chart

Perpetual (PPT) $42.09 / -5.37%; a poor Q3 funds under management (FUM) update today saw the stock under a lot of pressure, tracking lower throughout the day. They said that they were managing $30.2bil, falling $2.6bil over the quarter which is a poor result - half of the decline was falling values of assets but they also saw a net outflow of $1.3bill, mostly coming from institutional investors – this highlights what we covered this morning around financials / fund managers being extremely leveraged to the fate of the markets, and the perception of the market. Falling asset prices = lower FUM but it also means less inflow, and in the case of PPT, net outflows. We hold PPT in the Income Portfolio and are now underwater.

Perpetual (PPT) Chart

A2 Milk (A2M) $11.70 / +0.86%; a good rebound from earlier lows (below $11.50) this morning with the stock closing slightly higher after the announcement of a deal to expand into South Korea through the pharmaceutical company Yuhan with sales expected to commence in the second half of this year. The two companies will launch a range of products using a2 sourced ingredients which will be exclusively distributed throughout South Korea by Yuhan, the most admired Korean company, according to this year’s Korean Management Association Awards!!!

We’d written about an aggressive trading buy sub $11.50 in A2 Milk and today that level was reached however right now we think have some cash in the portfolio is prudent.

A2 Milk (A2M) Chart

OUR CALLS

We sold Woodside (WPL) today from the Platinum and Income Portfolios around $30.60.

Woodside (WPL) Chart

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 16/04/2018. 5.21PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here